重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

The goal of a monetary union in ECOWAS has long been an objective of the organization, going back to its formation in 1975, and is intended to【82】a broader integration process that would include enhanced regional trade and【83】institutions. In the colonial period, currency boards linked sets of countries in the region.【84】independence,【85】, these currency boards were【86】, with the【87】of the CFA franc zone, which included the francophone countries of the region. Although there have been attempts to advance file agenda of ECOWAS monetary cooperation, political problems and other economic priorities in several of the region's countries have to【88】inhibited progress. Although some problems remain, the recent initiative has been bolstered by the election in 1999 of a democratic government and a leader who is committed to regional【89】in Nigeria, the largest economy of the region, raising hopes that the long-delayed project can be【90】.

(41)

A.committed

B.devoted

C.adjusted

D.attributed

更多“On April 20, 2000, in Accra, Ghana, the leaders of six West African countries declared the”相关的问题

更多“On April 20, 2000, in Accra, Ghana, the leaders of six West African countries declared the”相关的问题

第1题

(b) A sale of industrial equipment to Deakin Co in May 2005 resulted in a loss on disposal of $0·3 million that has

been separately disclosed on the face of the income statement. The equipment cost $1·2 million when it was

purchased in April 1996 and was being depreciated on a straight-line basis over 20 years. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

第3题

(A) It’s April 18th

(B) It’s Sunday

(C) It’s August

(D) I was born in 1988

第4题

A.3.2N.m

B.5N.m

C.2000 N.m

D.1280N.m

第5题

第6题

A.40 Pa

B.20 Pa

C.30 Pa

D.60 Pa

第7题

A.2000~2250ml

B.2300-2500mI

C.3000—3250ml

D.3400—3500ml

E.3600—4000ml

第8题

A.40 Pa

B.20 Pa

C.30 Pa

D.60 Pa

第9题

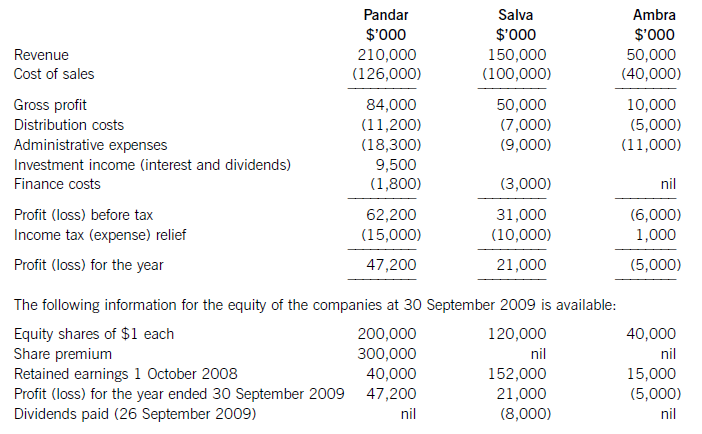

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

第10题

(c) Assuming that Joanne registers for value added tax (VAT) with effect from 1 April 2006:

(i) Calculate her income tax (IT) and capital gains tax (CGT) payable for the year of assessment 2005/06.

You are not required to calculate any national insurance liabilities in this sub-part. (6 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!