重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

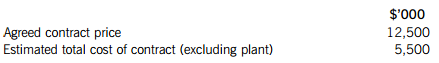

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

更多“On 1 October 2009 Mocca entered into a construction contract that was expected to take 27”相关的问题

更多“On 1 October 2009 Mocca entered into a construction contract that was expected to take 27”相关的问题

第1题

Riley acquired a non-current asset on 1 October 2009 at a cost of $100,000 which had a useful economic life of ten years and a nil residual value.The asset had been correctly depreciated up to 30 September 2014.At that date the asset was damaged and an impairment review was performed.On 30 September 2014, the fair value of the asset less costs to sell was $30,000 and the expected future cash flows were $8,500 per annum for the next five years.

The current cost of capital is 10% and a five year annuity of $1 per annum at 10% would have a present value of $3·79

What amount would be charged to profit or loss for the impairment of this asset for the year ended 30 September 2014().

A、$17,785

B、$20,000

C、$30,000

D、$32,215

第2题

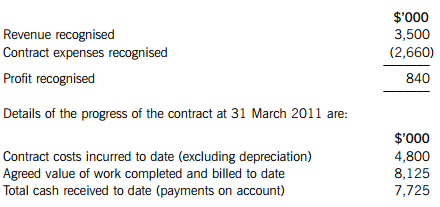

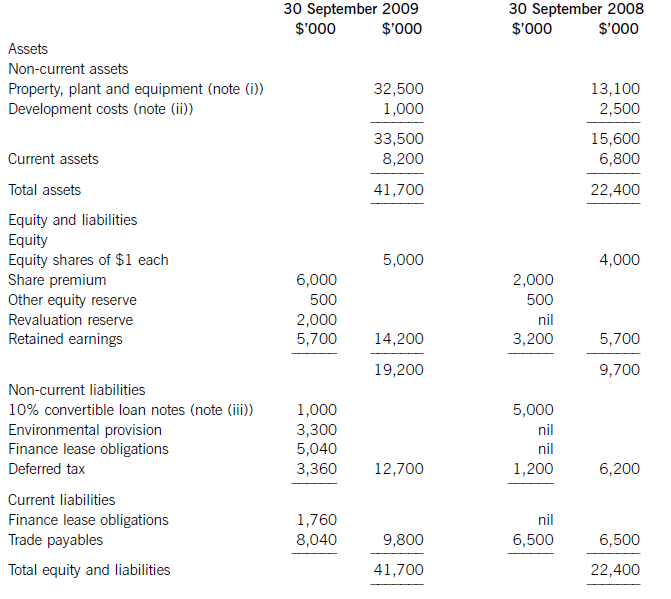

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

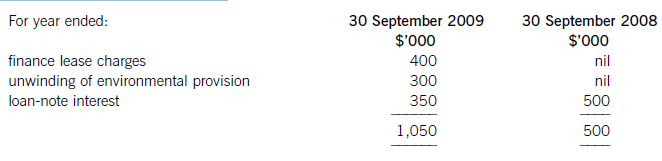

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

第3题

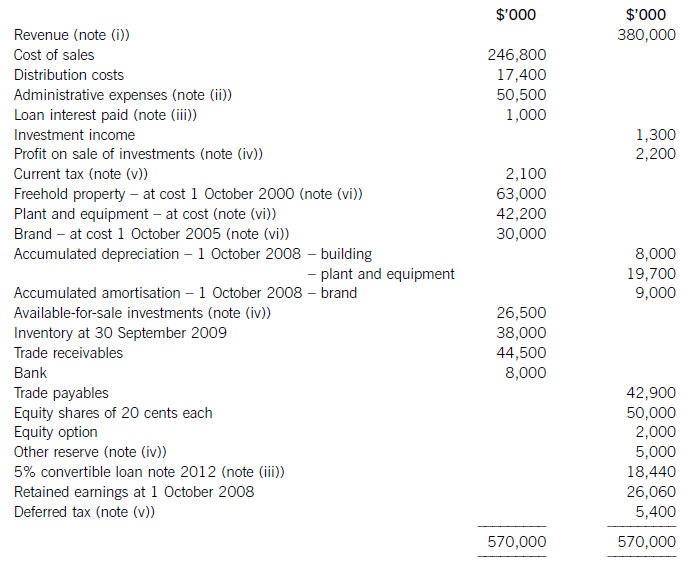

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

第4题

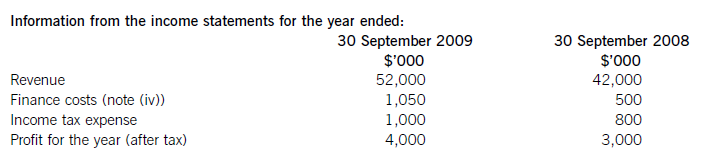

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

第5题

The heightened alert【2】an emergency meeting with flu experts in Geneva that assembled after a sharp rise in cases in Australia, and rising【3】in Britain, Japan, Chile and elsewhere.

But the epidemic is "【4】" in severity, according to Margaret Chan, the organization's director general,【5】the overwhelming majority of patients experiencing only mild symptoms and a full recovery, often in the【6】of any medical treatment.

The outbreak came to global【7】in late April 2009, when Mexican authorities noted an unusually large number of hospitalizations and deaths【8】healthy adults. As much of Mexico City shut down at the height of a panic, cases began to【9】in New York City, the southwestern United States and around the world.

In the United States, new cases seemed to fade【10】warmer weather arrived. But in late September 2009, officials reported there was【11】flu activity in almost every state and that virtually all the【12】tested are the new swine flu, also known as (A) H1N1, not seasonal flu. In the U. S. , it has【13】more than one million people, and caused more than 600 deaths and more than 6,000 hospitalizations.

Federal health officials【14】Tamiflu for children from the national stockpile and began【15】orders from the states for the new swine flu vaccine. The new vaccine, which is different from the annual flu vaccine, is【16】ahead of expectations. More than three million doses were to be made available in early October 2009, though most of those【17】dose were of the FluMist nasal spray type, which is not【18】for pregnant women, people over 50 or those with breathing difficulties, heart disease or several other【19】. But it was still possible to vaccinate people in other high-risk groups: health care workers, people【20】infants and healthy young people.

(1)

A.criticized

B.appointed

C.commented

D.designated

第6题

(a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giving the definition of a non-current asset as ‘a physical asset of substantial cost, owned by the company, which will last longer than one year’.

Required:

Provide an explanation to your assistant of the weaknesses in his definition of non-current assets when

compared to the International Accounting Standards Board’s (IASB) view of assets. (4 marks)

(b) The same assistant has encountered the following matters during the preparation of the draft financial statements of Darby for the year ending 30 September 2009. He has given an explanation of his treatment of them.

(i) Darby spent $200,000 sending its staff on training courses during the year. This has already led to an

improvement in the company’s efficiency and resulted in cost savings. The organiser of the course has stated that the benefits from the training should last for a minimum of four years. The assistant has therefore treated the cost of the training as an intangible asset and charged six months’ amortisation based on the average date during the year on which the training courses were completed. (3 marks)

(ii) During the year the company started research work with a view to the eventual development of a new

processor chip. By 30 September 2009 it had spent $1·6 million on this project. Darby has a past history

of being particularly successful in bringing similar projects to a profitable conclusion. As a consequence the

assistant has treated the expenditure to date on this project as an asset in the statement of financial position.

Darby was also commissioned by a customer to research and, if feasible, produce a computer system to

install in motor vehicles that can automatically stop the vehicle if it is about to be involved in a collision. At

30 September 2009, Darby had spent $2·4 million on this project, but at this date it was uncertain as to

whether the project would be successful. As a consequence the assistant has treated the $2·4 million as an

expense in the income statement. (4 marks)

(iii) Darby signed a contract (for an initial three years) in August 2009 with a company called Media Today to

install a satellite dish and cabling system to a newly built group of residential apartments. Media Today will

provide telephone and television services to the residents of the apartments via the satellite system and pay

Darby $50,000 per annum commencing in December 2009. Work on the installation commenced on

1 September 2009 and the expenditure to 30 September 2009 was $58,000. The installation is expected

to be completed by 31 October 2009. Previous experience with similar contracts indicates that Darby will

make a total profit of $40,000 over the three years on this initial contract. The assistant correctly recorded

the costs to 30 September 2009 of $58,000 as a non-current asset, but then wrote this amount down to

$40,000 (the expected total profit) because he believed the asset to be impaired.

The contract is not a finance lease. Ignore discounting. (4 marks)

Required:

For each of the above items (i) to (iii) comment on the assistant’s treatment of them in the financial

statements for the year ended 30 September 2009 and advise him how they should be treated under

International Financial Reporting Standards.

Note: the mark allocation is shown against each of the three items above.

第7题

英译汉:The People's Republic of China (PRC), founded on October 1, 1949, covers an area of 9.6 million square kilometers.

第8题

As requested _____ your E-mail of October 1, we are sending you _____ the required quotation sheet.

A. in, herewith

B. for, herewith

C. for, in

D. on, herewith

第11题

(1)( ) 29th November 2008

(2)( ) 4th December 2008

(3)( ) 14th December 2008

(4)( ) 51h December 2008

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!