重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A. high as last year

B. high as last year's

C. as high as last year's

D. as high as last year

更多“This year's yield will be().”相关的问题

更多“This year's yield will be().”相关的问题

第1题

A.0.97%

B.2.6%

C.2.7%

D.5.6%

第2题

A.increased

B.decreased

C.remained constant

第3题

A. held until maturity in 3 years.

B. called in year 1.

C. called in year 2.

第4题

remaining to maturity at the time of purchase. The coupon interest rate is 10% and par value

is $1,000. At the time you purchased the bond, the yield to maturity was 8%. If you sold the

bond after receiving the first interest payment and the bond's yield to maturity had changed to

7%, your annual total rate of return on holding the bond for that year would have been

().

A.7.00%

B.8.00%

C.9.95%

D.11.95%

E.none of the above

第5题

Bao Capital issed a 5-year, $50 million face, 6% semiannual bond when market interest rates were 7%.The market yield of the bonds was 8% at the beginning of the next year.What is the initial balance sheet liability, and what is the interest expense that the company should report for the first half of the second year of the bond’s life (the third semiannual period)”

第6题

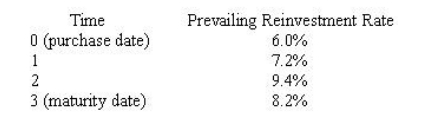

Three years ago you purchased a bond for $974.69. The bond had three years

to maturity, a coupon rate of 8%, paid annually, and a face value of $1,000. Each year you

reinvested all coupon interest at the prevailing reinvestment rate shown in the table below.

Today is the bond's maturity date. What is your realized compound yield on the bond?()

A.6.43%

B.7.96%

C.8.23%

D.8.97%

E.9.13%

第7题

Bao Capital issed a 5-year, $50 million face, 6% semiannual bond when market interest rates were 7%.The market yield of the bonds was 8% at the beginning of the next year.What is the initial balance sheet liability, and what is the interest expense that the company should report for the first half of the second year of the bond’s life (the third semiannual period)”

第8题

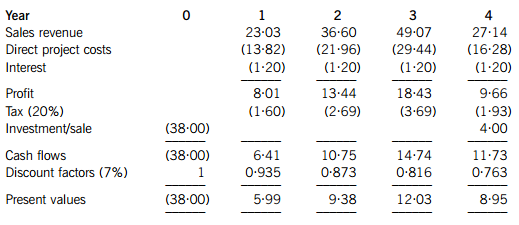

Section B – TWO questions ONLY to be attempted

You have recently commenced working for Burung Co and are reviewing a four-year project which the company is considering for investment. The project is in a business activity which is very different from Burung Co’s current line of business.

The following net present value estimate has been made for the project:

All figures are in $ million

Net present value is negative $1·65 million, and therefore the recommendation is that the project should not be accepted.

In calculating the net present value of the project, the following notes were made:

(i) Since the real cost of capital is used to discount cash flows, neither the sales revenue nor the direct project costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 8% per year and to the direct project costs is 4% per year.

(ii) The project will require an initial investment of $38 million. Of this, $16 million relates to plant and machinery, which is expected to be sold for $4 million when the project ceases, after taking any taxation and inflation impact into account.

(iii) Tax allowable depreciation is available on the plant and machinery at 50% in the first year, followed by 25% per year thereafter on a reducing balance basis. A balancing adjustment is available in the year the plant and machinery is sold. Burung Co pays 20% tax on its annual taxable profits. No tax allowable depreciation is available on the remaining investment assets and they will have a nil value at the end of the project.

(iv) Burung Co uses either a nominal cost of capital of 11% or a real cost of capital of 7% to discount all projects, given that the rate of inflation has been stable at 4% for a number of years.

(v) Interest is based on Burung Co’s normal borrowing rate of 150 basis points over the 10-year government yield rate.

(vi) At the beginning of each year, Burung Co will need to provide working capital of 20% of the anticipated sales revenue for the year. Any remaining working capital will be released at the end of the project.

(vii) Working capital and depreciation have not been taken into account in the net present value calculation above, since depreciation is not a cash flow and all the working capital is returned at the end of the project.

It is anticipated that the project will be financed entirely by debt, 60% of which will be obtained from a subsidised loan scheme run by the government, which lends money at a rate of 100 basis points below the 10-year government debt yield rate of 2·5%. Issue costs related to raising the finance are 2% of the gross finance required. The remaining 40% will be funded from Burung Co’s normal borrowing sources. It can be assumed that the debt capacity available to Burung Co is equal to the actual amount of debt finance raised for the project.

Burung Co has identified a company, Lintu Co, which operates in the same line of business as that of the project it is considering. Lintu Co is financed by 40 million shares trading at $3·20 each and $34 million debt trading at $94 per $100. Lintu Co’s equity beta is estimated at 1·5. The current yield on government treasury bills is 2% and it is estimated that the market risk premium is 8%. Lintu Co pays tax at an annual rate of 20%.

Both Burung Co and Lintu Co pay tax in the same year as when profits are earned.

Required:

(a) Calculate the adjusted present value (APV) for the project, correcting any errors made in the net present value estimate above, and conclude whether the project should be accepted or not. Show all relevant calculations. (15 marks)

(b) Comment on the corrections made to the original net present value estimate and explain the APV approach taken in part (a), including any assumptions made. (10 marks)

第9题

A.remove

B.removal

C.remover

D.removable

第10题

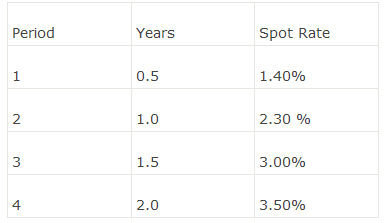

Using the BEY (bond-equivalent yield) spot rates for U.S. Treasury yields provided in the following table, the 6-month forward rate one year from now on a bond-equivalent yield basis is closest to:

A. 4.41%

B. 2.20%

C. 2.30%

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!