重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A. financing activities section

B. investing activities section

C. operating activities section

D. supplemental statement

更多“Cash investments made by the owner to the business are reported on the statement of c”相关的问题

更多“Cash investments made by the owner to the business are reported on the statement of c”相关的问题

第1题

)

此题为判断题(对,错)。

第2题

下列属于投资活动产生的现金流量的有()。

A、net cash flows from operating activities

B、cash receipts from disposals and returns of investments

C、cash receipts from returns on investments

D、total cash out flows for operating activities

第3题

A.Statement of financial position.

B.Statement of cash flows.

C.Balance sheet.

D.Statement of owner’s equity.

第4题

A.An item such as a money order, traveler's check, or check from a customer.

B.An account receivable from a reliable customer who has always paid bills within the discount perio

C.A guaranteed line of credit at the company's bank.

D.Very liquid short-term investments such as U.S. Treasury bills and commercial paper.

第5题

Section C

Directions: In this section, you will hear a passage three times. When the passage is read for the first time, you should listen carefully for its general idea. When the passage is read for the second time, you are required to fill in the blanks numbered from 36 to 43 with the exact words you have just heard. For blanks numbered from 44 to 46 you are required to fill in the missing information. For these blanks, you can either use the exact words you have just heard or write down the

China has outlined a new approach to foreign investment, with planners saying they will now focus less on attracting large amounts of cash and more on selecting investments that will bring skills and technology into the country. The change in tactics,【B1】______ in an official document published by the National Development and Reform. Commission, comes after more than a year of【B2】______ debate over the role foreign investors should play in China's economy. China has long been one of the world's top【B3】______ for foreign investment, and international companies【B4】______ in more than $70 billion last year, drawn by the country's low costs,【B5】______ prowess and huge domestic market. But the inroads have caused some unease among both ordinary people and officials, who also want to see domestic companies do well. The new foreign-in vestment plan, which isn't a【B6】______ blueprint but rather a statement of broad【B7】______ , does say that regulators will look more closely at foreign takeovers of local companies and other issues of "national economic security" that have received increasing attention recently. But the vision it advances represents neither an attempt to【B8】______ close off China's economy nor a new round of liberalization. The planning agency said【B9】______ . For instance, new investments by foreign companies will face stricter environmental and land-use standards. On the other hand,【B10】______ . The plan said China will continue to open up service industries,【B11】______ . The commission also pledged to improve the business environment by reducing red tape and strengthening enforcement of intellectual-property rights.

【B1】

第6题

Tess Mulroney, a veteran options investor, wishes to do some speculating and hedging with options, but isn’t sure the derivatives currently available are attractively priced. Before making any transactions, Mulroney puts her calculator to work to determine a fair price for the options.

First, Mulroney seeks to protect a large variable-rate investment. She has loaned $40 million to her nephew’s construction company. The loan is payable in one year, and the current interest rate is 7.6 percent. Based on data provided by her brokerage house, Mulroney believes interest rates will fall sharply over the next year, with a 70 percent chance of a decline to 5.9 percent and a 30 percent chance of a decline to 4.7 percent.

To protect her cash flows, Mulroney is considering the purchase of a 6.2 percent floor. Mulroney knows a banker who writes such options, but she must come to him with a price in mind.

Next on Mulroney’s list is call options on Merrill Materials stock. She has obtained the followingassumptions through a subscription options service:

The stock trades for $35 per share.

The chance of an upward movement over the next year is 60 percent.

The likely downward movement is 20 percent.

At-the-money calls currently sell for $4.75.

Despite her experience, Mulroney knows she always has more to learn. So she then reviews some technical material on options that she found on the Internet. Mulroney spends the next hour reading up on sensitivity factors related to option pricing.

Later that day, Mulroney meets with Ben Glanda, her financial adviser. He has prepared some investment recommendations and advice for Mulroney.

His first suggestion addresses a series of investments Mulroney was considering. She had proposed buying a stock, buying a European put option on the stock, and writing a call option. Glanda has proposed an alternative investment that will be simpler to make.

Next Glanda attempts to convince Mulroney to start using an alternate method for valuing her options. Glanda suggests using the Black-Scholes-Merton model because of its precision and ability to consider more factors, but Mulroney prefers the binomial model because it requires fewer assumptions.

Mulroney doesn’t like the Black-Scholes Merton model for the following reasons:

It does not work for American options.

It does not consider volatility of interest rates.

It does not reflect the compounding of returns.

It does not work for assets that generate cash flows.

Part 1)

Which of Mulroney’s arguments against the Black-Scholes-Merton model is least compelling? Her statement about:

A) American options.

B) interest-rate volatility.

C) compounding returns.

D) cash flows.

第7题

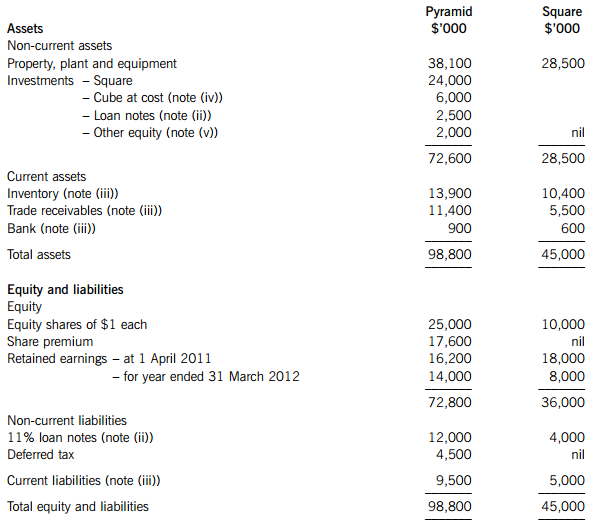

The summarised statements of financial position of the two companies as at 31 March 2012 are:

The following information is relevant:

(i) At the date of acquisition, Pyramid conducted a fair value exercise on Square’s net assets which were equal to their carrying amounts with the following exceptions:

– An item of plant had a fair value of $3 million above its carrying amount. At the date of acquisition it had a remaining life of five years. Ignore deferred tax relating to this fair value.

– Square had an unrecorded deferred tax liability of $1 million, which was unchanged as at 31 March 2012.

Pyramid’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose a share price for Square of $3·50 each is representative of the fair value of the shares held by the non-controlling interest.

(ii) Immediately after the acquisition, Square issued $4 million of 11% loan notes, $2·5 million of which were bought by Pyramid. All interest due on the loan notes as at 31 March 2012 has been paid and received.

(iii) Pyramid sells goods to Square at cost plus 50%. Below is a summary of the recorded activities for the year ended 31 March 2012 and balances as at 31 March 2012:

On 26 March 2012, Pyramid sold and despatched goods to Square, which Square did not record until they were received on 2 April 2012. Square’s inventory was counted on 31 March 2012 and does not include any goods purchased from Pyramid.

On 27 March 2012, Square remitted to Pyramid a cash payment which was not received by Pyramid until 4 April 2012. This payment accounted for the remaining difference on the current accounts.

(iv) Pyramid bought 1·5 million shares in Cube on 1 October 2011; this represents a holding of 30% of Cube’s equity. At 31 March 2012, Cube’s retained profits had increased by $2 million over their value at 1 October 2011. Pyramid uses equity accounting in its consolidated financial statements for its investment in Cube.

(v) The other equity investments of Pyramid are carried at their fair values on 1 April 2011. At 31 March 2012, these had increased to $2·8 million.

(vi) There were no impairment losses within the group during the year ended 31 March 2012.

Required:

Prepare the consolidated statement of financial position for Pyramid as at 31 March 2012.

第8题

Tess Mulroney, a veteran options investor, wishes to do some speculating and hedging with options, but isn’t sure the derivatives currently available are attractively priced. Before making any transactions, Mulroney puts her calculator to work to determine a fair price for the options.

First, Mulroney seeks to protect a large variable-rate investment. She has loaned $40 million to her nephew’s construction company. The loan is payable in one year, and the current interest rate is 7.6 percent. Based on data provided by her brokerage house, Mulroney believes interest rates will fall sharply over the next year, with a 70 percent chance of a decline to 5.9 percent and a 30 percent chance of a decline to 4.7 percent.

To protect her cash flows, Mulroney is considering the purchase of a 6.2 percent floor. Mulroney knows a banker who writes such options, but she must come to him with a price in mind.

Next on Mulroney’s list is call options on Merrill Materials stock. She has obtained the followingassumptions through a subscription options service:

The stock trades for $35 per share.

The chance of an upward movement over the next year is 60 percent.

The likely downward movement is 20 percent.

At-the-money calls currently sell for $4.75.

Despite her experience, Mulroney knows she always has more to learn. So she then reviews some technical material on options that she found on the Internet. Mulroney spends the next hour reading up on sensitivity factors related to option pricing.

Later that day, Mulroney meets with Ben Glanda, her financial adviser. He has prepared some investment recommendations and advice for Mulroney.

His first suggestion addresses a series of investments Mulroney was considering. She had proposed buying a stock, buying a European put option on the stock, and writing a call option. Glanda has proposed an alternative investment that will be simpler to make.

Next Glanda attempts to convince Mulroney to start using an alternate method for valuing her options. Glanda suggests using the Black-Scholes-Merton model because of its precision and ability to consider more factors, but Mulroney prefers the binomial model because it requires fewer assumptions.

Mulroney doesn’t like the Black-Scholes Merton model for the following reasons:

It does not work for American options.

It does not consider volatility of interest rates.

It does not reflect the compounding of returns.

It does not work for assets that generate cash flows.

Part 3)

During the course of her review, Mulroney reads about a factor related to interest rates. The variable is negative for put options. Mulroney is reading about:

A) rho.

B) gamma.

C) vega.

D) theta.

第9题

Tess Mulroney, a veteran options investor, wishes to do some speculating and hedging with options, but isn’t sure the derivatives currently available are attractively priced. Before making any transactions, Mulroney puts her calculator to work to determine a fair price for the options.

First, Mulroney seeks to protect a large variable-rate investment. She has loaned $40 million to her nephew’s construction company. The loan is payable in one year, and the current interest rate is 7.6 percent. Based on data provided by her brokerage house, Mulroney believes interest rates will fall sharply over the next year, with a 70 percent chance of a decline to 5.9 percent and a 30 percent chance of a decline to 4.7 percent.

To protect her cash flows, Mulroney is considering the purchase of a 6.2 percent floor. Mulroney knows a banker who writes such options, but she must come to him with a price in mind.

Next on Mulroney’s list is call options on Merrill Materials stock. She has obtained the followingassumptions through a subscription options service:

The stock trades for $35 per share.

The chance of an upward movement over the next year is 60 percent.

The likely downward movement is 20 percent.

At-the-money calls currently sell for $4.75.

Despite her experience, Mulroney knows she always has more to learn. So she then reviews some technical material on options that she found on the Internet. Mulroney spends the next hour reading up on sensitivity factors related to option pricing.

Later that day, Mulroney meets with Ben Glanda, her financial adviser. He has prepared some investment recommendations and advice for Mulroney.

His first suggestion addresses a series of investments Mulroney was considering. She had proposed buying a stock, buying a European put option on the stock, and writing a call option. Glanda has proposed an alternative investment that will be simpler to make.

Next Glanda attempts to convince Mulroney to start using an alternate method for valuing her options. Glanda suggests using the Black-Scholes-Merton model because of its precision and ability to consider more factors, but Mulroney prefers the binomial model because it requires fewer assumptions.

Mulroney doesn’t like the Black-Scholes Merton model for the following reasons:

It does not work for American options.

It does not consider volatility of interest rates.

It does not reflect the compounding of returns.

It does not work for assets that generate cash flows.

Part 6)

If Glanda is attempting to duplicate the effects of Mulroney’s proposed stock and option investment, he should recommend the:

A) sale of a riskless bond.

B) purchase of a riskless bond.

C) purchase of a stock.

D) sale of a stock.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!