重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

(ii) why the ‘fair value option’ was initially introduced and why it has caused such concern. (5 marks)

更多“(ii) why the ‘fair value option’ was initially introduced and why it has caused such conce”相关的问题

更多“(ii) why the ‘fair value option’ was initially introduced and why it has caused such conce”相关的问题

第2题

A.I only

B.II only

C.I and II only

D.II and III only

第3题

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

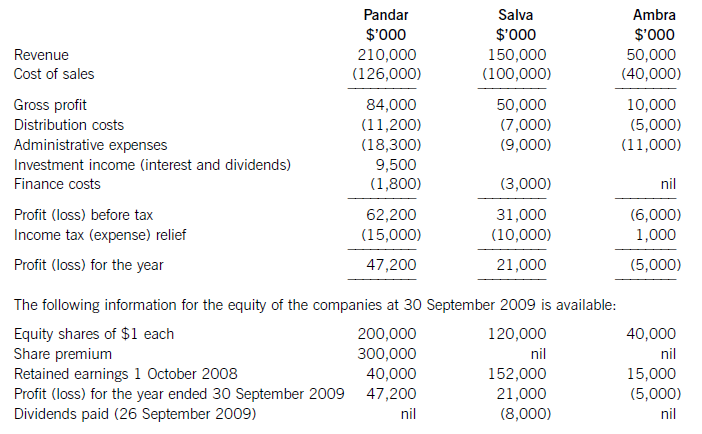

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

第4题

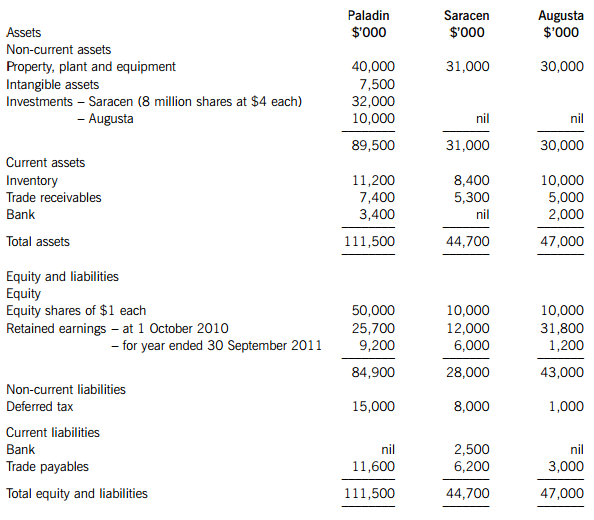

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

第5题

A.She will have more time to prepare for it.

B.The jobs available there are more suited to her interests.

C.One of her sociology professors helped organize it.

D.Fewer people will be looking for positions th

E.

第6题

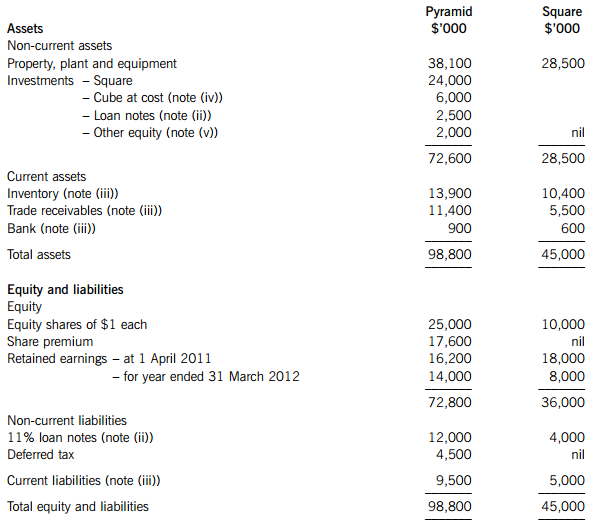

The summarised statements of financial position of the two companies as at 31 March 2012 are:

The following information is relevant:

(i) At the date of acquisition, Pyramid conducted a fair value exercise on Square’s net assets which were equal to their carrying amounts with the following exceptions:

– An item of plant had a fair value of $3 million above its carrying amount. At the date of acquisition it had a remaining life of five years. Ignore deferred tax relating to this fair value.

– Square had an unrecorded deferred tax liability of $1 million, which was unchanged as at 31 March 2012.

Pyramid’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose a share price for Square of $3·50 each is representative of the fair value of the shares held by the non-controlling interest.

(ii) Immediately after the acquisition, Square issued $4 million of 11% loan notes, $2·5 million of which were bought by Pyramid. All interest due on the loan notes as at 31 March 2012 has been paid and received.

(iii) Pyramid sells goods to Square at cost plus 50%. Below is a summary of the recorded activities for the year ended 31 March 2012 and balances as at 31 March 2012:

On 26 March 2012, Pyramid sold and despatched goods to Square, which Square did not record until they were received on 2 April 2012. Square’s inventory was counted on 31 March 2012 and does not include any goods purchased from Pyramid.

On 27 March 2012, Square remitted to Pyramid a cash payment which was not received by Pyramid until 4 April 2012. This payment accounted for the remaining difference on the current accounts.

(iv) Pyramid bought 1·5 million shares in Cube on 1 October 2011; this represents a holding of 30% of Cube’s equity. At 31 March 2012, Cube’s retained profits had increased by $2 million over their value at 1 October 2011. Pyramid uses equity accounting in its consolidated financial statements for its investment in Cube.

(v) The other equity investments of Pyramid are carried at their fair values on 1 April 2011. At 31 March 2012, these had increased to $2·8 million.

(vi) There were no impairment losses within the group during the year ended 31 March 2012.

Required:

Prepare the consolidated statement of financial position for Pyramid as at 31 March 2012.

第7题

第8题

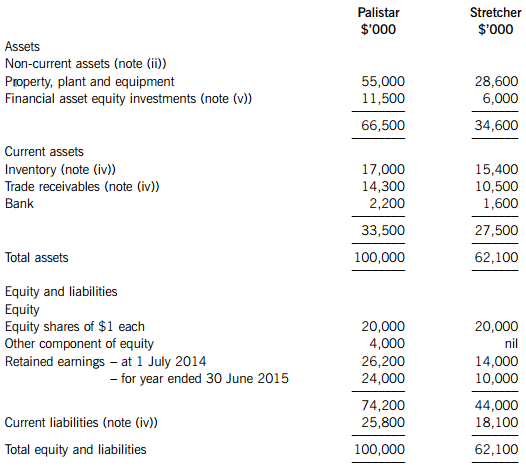

(a) On 1 January 2015, Palistar acquired 75% of Stretcher’s equity shares by means of an immediate share exchange of two shares in Palistar for five shares in Stretcher. The fair value of Palistar and Stretcher’s shares on 1 January 2015 were $4·00 and $3·00 respectively. In addition to the share exchange, Palistar will make a cash payment of $1·32 per acquired share, deferred until 1 January 2016. Palistar has not recorded any of the consideration for Stretcher in its financial statements. Palistar’s cost of capital is 10% per annum.

The summarised statements of financial position of the two companies as at 30 June 2015 are:

The following information is relevant:

(i) Stretcher’s business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year.

(ii) At the date of acquisition, the fair value of Stretcher’s net assets was equal to their carrying amounts with the following exceptions:

An item of plant had a fair value of $2 million below its carrying value. At the date of acquisition it had a remaining life of two years.

The fair value of Stretcher’s investments was $7 million (see also note (v)).

Stretcher owned the rights to a popular mobile (cell) phone game. At the date of acquisition, a specialist valuer estimated that the rights were worth $12 million and had an estimated remaining life of five years.

(iii) Following an impairment review, consolidated goodwill is to be written down by $3 million as at 30 June 2015.

(iv) Palistar sells goods to Stretcher at cost plus 30%. Stretcher had $1·8 million of goods in its inventory at 30 June 2015 which had been supplied by Palistar. In addition, on 28 June 2015, Palistar processed the sale of $800,000 of goods to Stretcher, which Stretcher did not account for until their receipt on 2 July 2015. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Stretcher before the year end. At 30 June 2015, Palistar had a trade receivable balance of $2·4 million due from Stretcher which differed to the equivalent balance in Stretcher’s books due to the sale made on 28 June 2015.

(v) At 30 June 2015, the fair values of the financial asset equity investments of Palistar and Stretcher were $13·2 million and $7·9 million respectively.

(vi) Palistar’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Stretcher’s share price at that date is representative of the fair value of the shares held by the non-controlling interest.

Required:

Prepare the consolidated statement of financial position for Palistar as at 30 June 2015. (25 marks)

(b) For many years, Dilemma has owned 35% of the voting shares and held a seat on the board of Myno which has given Dilemma significant influence over Myno. The other shares (65%) in Myno were held by many other shareholders who all owned less than 10% of the share capital. On this basis, Dilemma considered Myno to be an associate and has used equity accounting to account for its investment.

In March 2015, Agresso made an offer to buy all of the shares of Myno. The offer was supported by the majority of Myno’s directors. Dilemma did not accept the offer and held on to its shares in Myno.

On 1 April 2015, Agresso announced that it had acquired the other 65% of the share capital of Myno and immediately convened a board meeting at which three of the previous directors of Myno were replaced, including the seat held by Dilemma.

Required:

Explain how the investment in Myno should be treated in the consolidated statement of profit or loss of Dilemma for the year ended 30 June 2015 and the consolidated statement of financial position at 30 June 2015. (5 marks)

第9题

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!