重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

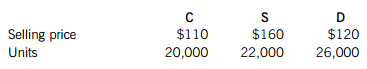

Hair Co manufactures three types of electrical goods for hair: curlers (C), straightening irons (S) and dryers (D.) The budgeted sales prices and volumes for the next year are as follows:

Each product is made using a different mix of the same materials and labour. Product S also uses new revolutionary technology for which the company obtained a ten-year patent two years ago. The budgeted sales volumes for all the products have been calculated by adding 10% to last year’s sales.

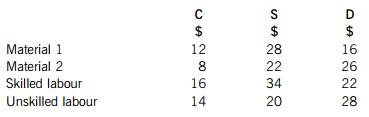

The standard cost card for each product is shown below.

Both skilled and unskilled labour costs are variable.

The general fixed overheads are expected to be $640,000 for the next year.

Required:

(a) Calculate the weighted average contribution to sales ratio for Hair Co.

Note: round all workings to 2 decimal places. (6 marks)

(b) Calculate the total break-even sales revenue for the next year for Hair Co.

Note: round all workings to 2 decimal places. (2 marks)

(c) Using the graph paper provided, draw a multi-product profit-volume (PV) chart showing clearly the profit/loss lines assuming:

(i) you are able to sell the products in order of the ones with the highest ranking contribution to sales ratios first; and

(ii) you sell the products in a constant mix.

Note: only one graph is required. (9 marks)

(d) Briefly comment on your findings in (c). (3 marks)

更多“Hair Co manufactures three types of electrical goods for hair: curlers (C), straightening”相关的问题

更多“Hair Co manufactures three types of electrical goods for hair: curlers (C), straightening”相关的问题

第1题

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

第2题

Hawthorn Enterprises Co

Hawthorn Enterprises Co (Hawthorn) manufactures and distributes fashion clothing to retail stores. Its year end was 31 March 2015. You are the audit manager and the year-end audit is due to commence shortly. The following three matters have been brought to your attention.

Hawthorn receives monthly statements from its main suppliers and although these have been retained, none have been reconciled to the payables ledger as at 31 March 2015. The engagement partner has asked the audit senior to recommend the procedures to be performed on supplier statements.(3 marks)

(ii) Bank reconciliation

During last year’s audit of Hawthorn’s bank and cash, significant cut off errors were discovered with a number of post year-end cheques being processed prior to the year end to reduce payables. The finance director has assured the audit engagement partner that this error has not occurred again this year and that the bank reconciliation has been carefully prepared. The audit engagement partner has asked that the bank reconciliation is comprehensively audited. (4 marks)

(iii) Receivables

Hawthorn’s receivables ledger has increased considerably during the year, and the year-end balance is $2·3 million compared to $1·4 million last year. The finance director of Hawthorn has requested that a receivables circularisation is not carried out as a number of their customers complained last year about the inconvenience involved in responding. The engagement partner has agreed to this request, and tasked you with identifying alternative procedures to confirm the existence and valuation of receivables. (5 marks)

Required:

Describe substantive procedures you would perform. to obtain sufficient and appropriate audit evidence in relation to the above three matters.

Note: The mark allocation is shown against each of the three matters above.

第3题

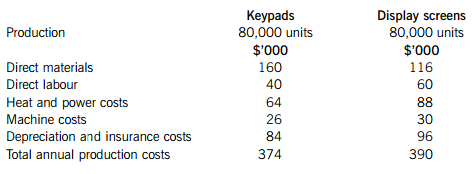

It currently produces and sells 80,000 units per annum, with production of them being restricted by the short supply of labour. Each control panel includes two main components – one key pad and one display screen. At present, Robber Co manufactures both of these components in-house. However, the company is currently considering outsourcing the production of keypads and/or display screens. A newly established company based in Burgistan is keen to secure a place in the market, and has offered to supply the keypads for the equivalent of $4·10 per unit and the display screens for the equivalent of $4·30 per unit. This price has been guaranteed for two years.

The current total annual costs of producing the keypads and the display screens are:

Notes:

1. Materials costs for keypads are expected to increase by 5% in six months’ time; materials costs for display screens are only expected to increase by 2%, but with immediate effect.

2. Direct labour costs are purely variable and not expected to change over the next year.

3. Heat and power costs include an apportionment of the general factory overhead for heat and power as well as the costs of heat and power directly used for the production of keypads and display screens. The general apportionment included is calculated using 50% of the direct labour cost for each component and would be incurred irrespective of whether the components are manufactured in-house or not.

4. Machine costs are semi-variable; the variable element relates to set up costs, which are based upon the number of batches made. The keypads’ machine has fixed costs of $4,000 per annum and the display screens’ machine has fixed costs of $6,000 per annum. Whilst both components are currently made in batches of 500, this would need to change, with immediate effect, to batches of 400.

5. 60% of depreciation and insurance costs relate to an apportionment of the general factory depreciation and insurance costs; the remaining 40% is specific to the manufacture of keypads and display screens.

Required:

(a) Advise Robber Co whether it should continue to manufacture the keypads and display screens in-house or whether it should outsource their manufacture to the supplier in Burgistan, assuming it continues to adopt a policy to limit manufacture and sales to 80,000 control panels in the coming year. (8 marks)

(b) Robber Co takes 0·5 labour hours to produce a keypad and 0·75 labour hours to produce a display screen. Labour hours are restricted to 100,000 hours and labour is paid at $1 per hour. Robber Co wishes to increase its supply to 100,000 control panels (i.e. 100,000 each of keypads and display screens). Advise Robber Co as to how many units of keypads and display panels they should either manufacture and/or outsource in order to minimise their costs. (7 marks)

(c) Discuss the non-financial factors that Robber Co should consider when making a decision about outsourcing the manufacture of keypads and display screens. (5 marks)

第4题

designs and manufactures wooden tables and chairs. The business has expanded rapidly in the last two years, since

the arrival of Patrick Tiler, an experienced sales and marketing manager.

The directors want to secure a loan of $3 million in order to expand operations, following the design of a completely

new range of wooden garden furniture. The directors have approached LCT Bank for the loan. The bank’s lending

criteria stipulate the following:

‘Loan applications must be accompanied by a detailed business plan, including an analysis of how the finance will

be used. LCT Bank need to see that the finance requested is adequate for the proposed business purpose. The

business plan must be supported by an assurance opinion on the adequacy of the requested finance.’

The $3 million finance raised will be used as follows:

$000

Construction of new factory 1,250

Purchase of new machinery 1,000

Initial supply of timber raw material 250

Advertising and marketing of new product 500

Your firm has agreed to review the business plan and to provide an assurance opinion on the completeness of the

finance request. A meeting will be held tomorrow to discuss this assignment.

Required:

(a) Identify and explain the matters relating to the assurance assignment that should be discussed at the meeting

with Mulligan Co. (8 marks)

第5题

(a) Contrast the role of internal and external auditors. (8 marks)

(b) Conoy Co designs and manufactures luxury motor vehicles. The company employs 2,500 staff and consistently makes a net profit of between 10% and 15% of sales. Conoy Co is not listed; its shares are held by 15 individuals, most of them from the same family. The maximum shareholding is 15% of the share capital.

The executive directors are drawn mainly from the shareholders. There are no non-executive directors because the company legislation in Conoy Co’s jurisdiction does not require any. The executive directors are very successful in running Conoy Co, partly from their training in production and management techniques, and partly from their ‘hands-on’ approach providing motivation to employees.

The board are considering a significant expansion of the company. However, the company’s bankers are

concerned with the standard of financial reporting as the financial director (FD) has recently left Conoy Co. The board are delaying provision of additional financial information until a new FD is appointed.

Conoy Co does have an internal audit department, although the chief internal auditor frequently comments that the board of Conoy Co do not understand his reports or provide sufficient support for his department or the internal control systems within Conoy Co. The board of Conoy Co concur with this view. Anders & Co, the external auditors have also expressed concern in this area and the fact that the internal audit department focuses work on control systems, not financial reporting. Anders & Co are appointed by and report to the board of Conoy Co.

The board of Conoy Co are considering a proposal from the chief internal auditor to establish an audit committee.

The committee would consist of one executive director, the chief internal auditor as well as three new appointees.

One appointee would have a non-executive seat on the board of directors.

Required:

Discuss the benefits to Conoy Co of forming an audit committee. (12 marks)

第6题

(i) Revaluation of property, plant and equipment (PPE)

At the beginning of the year, management undertook an extensive review of Elounda Co’s non-current asset valuations and as a result decided to update the carrying value of all PPE. The finance director, Peter Dullman, contacted his brother, Martin, who is a valuer and requested that Martin’s firm undertake the valuation, which took place in August 20X5. (5 marks)

(ii) Inventory valuation

Your firm attended the year-end inventory count for Elounda Co and ascertained that the process for recording work in progress (WIP) and finished goods was acceptable. Both WIP and finished goods are material to the financial statements and the quantity and stage of completion of all ongoing production was recorded accurately during the count.

During the inventory count, the count supervisor noted that a consignment of finished goods, compound E243, with a value of $720,000, was defective in that the chemical mix was incorrect. The finance director believes that compound E243 can still be sold at a discounted sum of $400,000. (6 marks)

(iii) Bank loan

Elounda Co secured a bank loan of $2·6 million on 1 October 20X4. Repayments of $200,000 are due quarterly, with a lump sum of $800,000 due for repayment in January 20X7. The company met all loan payments in 20X5 on time, but was late in paying the April and July 20X6 repayments. (4 marks)

Required:

(a) Describe substantive procedures you should perform. to obtain sufficient, appropriate audit evidence in relation to the above three matters.

Note: The mark allocation is shown against each of the three matters above.

(b) Describe the procedures which the auditor of Elounda Co should perform. in assessing whether or not the company is a going concern. (5 marks)

第7题

Eagle has experienced increased competition and as a result, in order to maintain its current levels of sales, it has decreased the selling price of its products significantly since September 2014. The finance director has informed your audit manager that he expects increased inventory levels at the year end. He also notified your manager that one of Eagle’s key customers has been experiencing financial difficulties. Therefore, Eagle has agreed that the customer can take a six-month payment break, after which payments will continue as normal. The finance director does not believe that any allowance is required against this receivable.

In October 2014 the financial controller of Eagle was dismissed. He had been employed by the company for over 20 years, and he has threatened to sue the company for unfair dismissal. The role of financial controller has not yet been filled and so his tasks have been shared between the existing finance department team. In addition, the purchase ledger supervisor left in August and a replacement has been appointed in the last week. However, for this period no supplier statement reconciliations or purchase ledger control account reconciliations were performed.

You have undertaken a preliminary analytical review of the draft year to date statement of profit or loss, and you are surprised to see a significant fall in administration expenses.

Required:

Explain FIVE audit risks, and the auditor’s response to each risk, in planning the audit of Eagle Heating Co.

第8题

(a) Define audit risk and the components of audit risk. (5 marks)

You are an audit supervisor of Amethyst & Co and are currently planning the audit of your client, Aquamarine Co (Aquamarine) which manufactures elevators. Its year end is 31 July 2016 and the forecast profit before tax is $15·2 million.

The company undertakes continuous production in its factory, therefore at the year end it is anticipated that work in progress will be approximately $950,000. In order to improve the manufacturing process, Aquamarine placed an order in April for $720,000 of new plant and machinery; one third of this order was received in May with the remainder expected to be delivered by the supplier in late July or early August.

At the beginning of the year, Aquamarine purchased a patent for $1·3 million which gives them the exclusive right to manufacture specialised elevator equipment for five years. In order to finance this purchase, Aquamarine borrowed $1·2 million from the bank which is repayable over five years.

In January 2016 Aquamarine outsourced its payroll processing to an external service organisation, Coral Payrolls Co (Coral). Coral handles all elements of the payroll cycle and sends monthly reports to Aquamarine detailing the payroll costs. Aquamarine ran its own payroll until 31 December 2015, at which point the records were transferred over to Coral.

The company has a policy of revaluing land and buildings and the finance director has announced that all land and buildings will be revalued at the year end. During a review of the management accounts for the month of May 2016, you have noticed that receivables have increased significantly on the previous year end and against May 2015.

The finance director has informed you that the company is planning to make approximately 65 employees redundant after the year end. No decision has been made as to when this will be announced, but it is likely to be prior to the year end.

Required:

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Aquamarine Co. (12 marks)

(c) Explain the additional factors Amethyst & Co should consider during the audit in relation to Aquamarine Co’s use of the payroll service organisation. (3 marks)

第9题

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

第11题

A.duplicates

B.manufactures

C.yields

D.generates

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!