重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

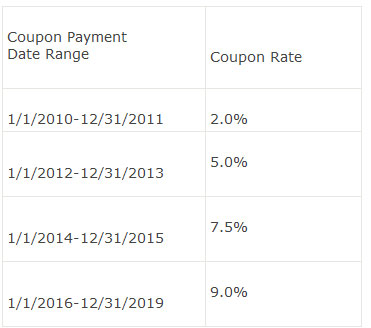

A 10-year bond is issued on January 1, 2010. Its contract requires that its coupon rate change over time as shown in the following table:

This security is best described as an example of a:

A. step-up note.

B. inverse floater.

C. deferred coupon bond.

更多“A 10-year bond is issued on January 1, 2010. Its contract requires that its coupon rat”相关的问题

更多“A 10-year bond is issued on January 1, 2010. Its contract requires that its coupon rat”相关的问题

第1题

A.increased

B.decreased

C.remained constant

第2题

A. $1077.2.

B. $1077.9.

C. $1075.0.

第3题

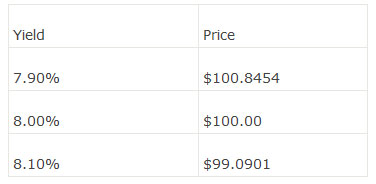

Using a 10 basis point rate shock, the duration of this bond is closes to:

A. 8.78

B. 17.56

C. 4.39

第4题

Taxable equivalent yield Yield ratio

A. 7.14 0.79

B. 5.64 0.79.

C. 5.64 1.19.

第5题

A、the total cost of borrowing over the 10-year life of the bond issue will be the same for both corporations.

B、the annual interest expense incurred by Jieda Co. will be equal to annual cash payments to bondholders.

C、Lide Co. appears to be a stronger company financially than Jieda Co.

D、the Jieda Co. bonds are convertible into common stock.

第6题

(1)Al-year,9%couponbond票面利率为9%的1年期债券

(2)A 10-year, 9% coupon bond票面利率为9%的10年期债券

(3)A 10-year, 5% coupon bond票面利率为5%的10年期债券

What will happen to the price of each of these bonds if rates decrease? Which bond will have the greatest change in price? Explain.

如果利率下降,这些债券的价格会发生什么变化?哪支债券的价格变化最大?请解释。

第7题

Issued on 1 January 2005, when the market rate of interest was 6%.

Bought back in an open market transaction on 1 January 2011, when the market rate of interest rate was 8%.

Which of the following statements best describes the effect of the bond repurchase on the financial statements for 2011? If the company uses the indirect method of calculating the cash from operations, there will be a:

A.$346,511 gain on the income statement.

B.$743,873 gain on the income statement.

C.$350,984 decrease in the cash from operations.

第8题

A.It's the same over the 10-year period.

B.It's getting worse over the 10-year period.

C.It's getting better over the 10-year period.

D.There is no way to solve the problem.

第9题

A.zero.

B.related to the security’s coupon reset frequency.

C.similar to an otherwise identical fixed-rate security.

第10题

(ii) On 1 July 2006 Petrie introduced a 10-year warranty on all sales of its entire range of stainless steel

cookware. Sales of stainless steel cookware for the year ended 31 March 2007 totalled $18·2 million. The

notes to the financial statements disclose the following:

‘Since 1 July 2006, the company’s stainless steel cookware is guaranteed to be free from defects in

materials and workmanship under normal household use within a 10-year guarantee period. No provision

has been recognised as the amount of the obligation cannot be measured with sufficient reliability.’

(4 marks)

Your auditor’s report on the financial statements for the year ended 31 March 2006 was unmodified.

Required:

Identify and comment on the implications of these two matters for your auditor’s report on the financial

statements of Petrie Co for the year ended 31 March 2007.

NOTE: The mark allocation is shown against each of the matters above.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!