重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A.zero.

B.$14.87.

C.$45.85.

D.$7.44.

E.none of the above.

更多“Consider a $1,000 par value 20-year zero coupon bond issued at a yield tomaturity of 10%. If you buy…”相关的问题

更多“Consider a $1,000 par value 20-year zero coupon bond issued at a yield tomaturity of 10%. If you buy…”相关的问题

第1题

A.8.28%

B.7.28%

C.6.28%

第2题

A. Decline then remain unchanged.

B. Decline then rise.

C. Rise then decline.

第3题

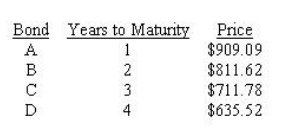

Consider the following $1,000 par value zero-coupon bonds:

44.The yield to maturity on bond A is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

45.The yield to maturity on bond B is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

46.The yield to maturity on bond C is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

47.The yield to maturity on bond D is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

第4题

A.both bonds will increase in value, but bond F will increase more than bond G

B.both bonds will increase in value, but bond G will increase more than bond F

C.both bonds will decrease in value, but bond F will decrease more than bond G

D.both bonds will decrease in value, but bond G will decrease more than bond F

E.none of the above

第5题

A. $1077.2.

B. $1077.9.

C. $1075.0.

第6题

A.give

B.giving

C.to give

D.having given

第7题

考虑下列式子描述的一个经济体的情况:

Y=C+I+G

Y=5000

G=1000

T=1000

C=250+0.75(Y-T)

I=1000-50r

a.在这一经济中,计算私人储蓄、公共储蓄和国民储蓄。

b.找出均衡利率。

c.现在假设G增加到1250。计算私人储蓄、公共储蓄以及国民储蓄。

d.找出新的均衡利率。

Consider an economy described by the following equations:

Y=C+I+G

Y=5,000

G=1,000

T=1,000

C=250+0.75(Y-T)

I=1,000-50r

a.In this economy, compute private saving, public saving, and national saving.

b.Find the equilibrium interest rate.

c.Now suppose that G rises to 1,250. Compute private saving, public saving, and national saving.

d.Find the new equilibrium interest rate.

第8题

考虑一下由以下方程式所描述的经济:

Y=C+I+G+NX

Y=5000

G=1000

T=1000

C=250+0.75(Y-T)

I=1000-50r

NX=500-500ε

r=r*=5

a.在这个经济中,求出国民储蓄、投资、贸易余额以及均衡汇率。

b.现在G增加到1250,求出国民储蓄、投资、贸易余额以及均衡汇率的值。解释你的结果。

c.现在假设世界利率从5%上升到10%(G又是1000),求出国民储蓄、投资、贸易余额以及均衡汇率的值。解释你的结果。

Consider an economy described by the following equations:

Y=C+I+G+NX

y=5000

G=1000

T=1000

C=250+0.75(Y-T)

I=1000-50r

NX=500-500ε

r=r*=5

a.In this economy, solve for national saving, investment, the trade balance, and the equilibrium exchange rate.

b.Suppose now that G rises to 1,250. Solve for national saving, investment, the trade balance, and the equilibrium exchange rate. Explain what you find.

c.Now suppose that the world interest rate rises from 5 to 10 percent. (G is again 1,000). Solve for national saving, investment, the trade balance, and the equilibrium exchange rate. Explain what you find.

第10题

A.above par value

B.below par

C.at or near par value

D.at a value unrelated to par

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!