重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

10. On 1 January 2009, a company that prepares its financial statements according to IFRS issued bonds with the following features:

·Face value £20,000,000

·Term 5 years

·Coupon rate 6% paid annually on December 31

·Market rate at issue 4%

The company did not elect to carry the bonds at fair value. In December 2011 the market rate on similar bonds had increased to 5% and the company decided to buy back (retire) the bonds after the coupon payment on December 31. As a result, the gain on retirement reported on the 2011 statement of income is closest to:

A. £340,410.

B. £371,882.

C. £382,556.

更多“On 1 January 2009, a company that prepares its financial statements according to IFRS issued bonds w…”相关的问题

更多“On 1 January 2009, a company that prepares its financial statements according to IFRS issued bonds w…”相关的问题

第1题

A、3.00 yuan.

B、2.50 yuan.

C、2.40 yuan.

D、2.00 yuan.

第2题

(c) At 1 June 2006, Router held a 25% shareholding in a film distribution company, Wireless, a public limited

company. On 1 January 2007, Router sold a 15% holding in Wireless thus reducing its investment to a 10%

holding. Router no longer exercises significant influence over Wireless. Before the sale of the shares the net asset

value of Wireless on 1 January 2007 was $200 million and goodwill relating to the acquisition of Wireless was

$5 million. Router received $40 million for its sale of the 15% holding in Wireless. At 1 January 2007, the fair

value of the remaining investment in Wireless was $23 million and at 31 May 2007 the fair value was

$26 million. (6 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

第3题

A、$0

B、$120

C、$200

D、$320

第4题

第5题

The following scenario relates to questions 6–10.

On 1 January 20X5, Blocks Co entered into new lease agreements as follows:

Agreement one This finance lease relates to a new piece of machinery. The fair value of the machine is $220,000. The agreement requires Blocks Co to pay a deposit of $20,000 on 1 January 20X5 followed by five equal annual instalments of $55,000, starting on 31 December 20X5. The implicit rate of interest is 11·65%.

Agreement two This three-year operating lease relates to a fleet of vans. The fair value of the vans is $120,000 and they have an estimated useful life of five years. The agreement requires Blocks Co to make no payment in year one and $48,000 in years two and three.

Agreement three This sale and leaseback relates to a cutting machine purchased by Blocks Co on 1 January 20X4 for $300,000. The carrying amount of the machine as at 31 December 20X4 was $250,000. On 1 January 20X5, it was sold to Cogs Co for $370,000 and Blocks Co will lease the machine back for five years, the remainder of its useful life, at $80,000 per annum.

According to IAS 17 Leases, which of the following is generally considered to be a characteristic of an operating, rather than a finance, lease?

A.Ownership of the assets is passed to the lessee by the end of the lease term

B.The lessor is responsible for the general maintenance and repair of the assets

C.The present value of the lease payments is approximately equal to the fair value of the asset

D.The lease term is for a major part of the useful life of the asset

For agreement one, what is the finance cost charged to profit or loss for the year ended 31 December 20X6?

A.$23,300

B.$12,451

C.$19,607

D.$16,891

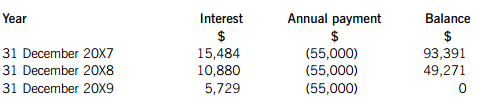

The following calculations have been prepared for agreement one: How will the finance lease obligation be shown in the statement of financial position as at 31 December 20X7?

A.$44,120 as a non-current liability and $49,271 as a current liability

B.$49,271 as a non-current liability and $44,120 as a current liability

C.$93,391 as a non-current liability

D.$93,391 as a current liability

For agreement three, what profit should be recognised for the year ended 31 December 20X5 as a result of the sale and leaseback?A.$24,000

B.$120,000

C.$70,000

D.$20,000

For agreement two, what would be the correct statement of profit or loss entries for the year ended 31 December 20X5?A.Depreciation of $24,000 and no lease rental expense

B.No depreciation and lease rental expense of $32,000

C.Depreciation of $24,000 and lease rental expense of $32,000

D.No depreciation and lease rental expense of $48,000

请帮忙给出每个问题的正确答案和分析,谢谢!

第6题

A.10. 0%

B.8.0%

C.7.8%

D.8.7%

第7题

第8题

A.January 1, 1900

B.January 1, 1950

C.January 1, 1960

D.January 1, 1970

第9题

A.$19,670,231

B.$19,940,622

C.$19,633,834

D.$19,663,523

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!