重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A.a coupon bond selling at a discount to par as a result of market yields increasing after the bond was issued.

B.a zero-coupon bond.

C.a coupon bond selling at a premium to par.

更多“Two amortizing bonds have the same maturity date and same yield to maturity. The rein”相关的问题

更多“Two amortizing bonds have the same maturity date and same yield to maturity. The rein”相关的问题

第1题

A.0.07%

B.2.6%

C.93.0%

D.The default correlation cannot be calculated with the information provided.

第2题

A. A putable bond and a floating-rate bond.

B. A mortgage-backed security and a convertible bond.

C. A zero-coupon bond and a Treasury strip.

第3题

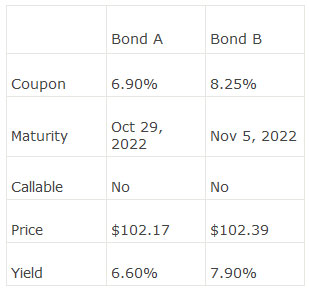

An analyst is evaluating the two bonds below:

Compared with Bond A, Bond B most likely will have:

A.less interest rate risk and more reinvestment risk.

B.more interest rate risk and less reinvestment risk.

C.less interest rate risk and less reinvestment risk.

第4题

A.both bonds will increase in value, but bond F will increase more than bond G

B.both bonds will increase in value, but bond G will increase more than bond F

C.both bonds will decrease in value, but bond F will decrease more than bond G

D.both bonds will decrease in value, but bond G will decrease more than bond F

E.none of the above

第5题

A. $405.

B. $808.

C. $1,000.

第6题

A.is callable.

B.has a lower coupon.

C.has a shorter maturity.

第7题

A. lower.

B. the same.

C. higher.

第8题

Section B – TWO questions ONLY to be attempted

GNT Co is considering an investment in one of two corporate bonds. Both bonds have a par value of $1,000 and pay coupon interest on an annual basis. The market price of the first bond is $1,079?68. Its coupon rate is 6% and it is due to be redeemed at par in five years. The second bond is about to be issued with a coupon rate of 4% and will also be redeemable at par in five years. Both bonds are expected to have the same gross redemption yields (yields to maturity).

GNT Co considers duration of the bond to be a key factor when making decisions on which bond to invest.

Required:

(a) Estimate the Macaulay duration of the two bonds GNT Co is considering for investment. (9 marks)

(b) Discuss how useful duration is as a measure of the sensitivity of a bond price to changes in interest rates. (8 marks)

第9题

A、$0

B、$200

C、$800

D、$20,000

E、$20,800

第10题

A. $25.23.

B. $27.83.

C. $29.46.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!