重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A.住客房

B.整理房

C.空房

D.走客房

搜题

搜题

更多“Available-for-Sale指的是()。A.住客房B.整理房C.空房D.走客房”相关的问题

更多“Available-for-Sale指的是()。A.住客房B.整理房C.空房D.走客房”相关的问题

第2题

第3题

Compared with IFRS,those prepared under U.S.GAAP generally accepted accounting principles,analysts may need to make adjustments related to:().

A.realized losses

B.unrealized gainsand losses for trading securities

C.unrealized gainsand losses for available-for-sale securities

第4题

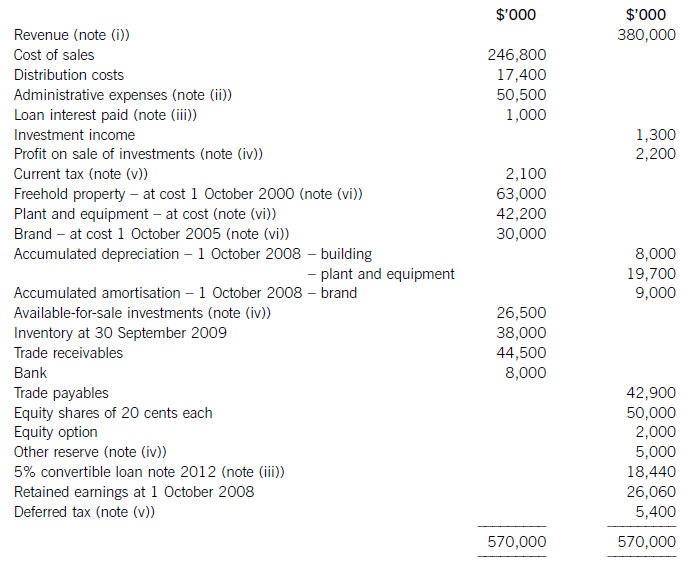

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

第5题

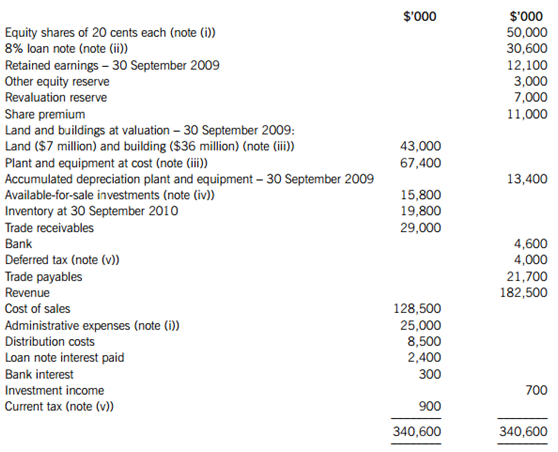

The following trial balance relates to Cavern as at 30 September 2010:

The following notes are relevant:

(i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 2010 of one new share for every four in issue at 42 cents each. The company paid ordinary dividends of 3 cents per share on 30 November 2009 and 5 cents per share on 31 May 2010. The dividend payments are included in administrative expenses in the trial balance.

(ii) The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective fi nance cost of 10% per annum.

(iii) Non-current assets:

Cavern revalues its land and building at the end of each accounting year. At 30 September 2010 the relevant value to be incorporated into the fi nancial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 2009) was 18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life (using straight-line depreciation with no residual value). Production using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount rate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for this future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010. All depreciation is charged to cost of sales.

(iv) The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 2010.

(v) A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2009. At 30 September 2010 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to the income statement. The income tax rate of Cavern is 25%.

Required:

(a) Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.

(b) Prepare the statement of changes in equity for Cavern for the year ended 30 September 2010.

(c) Prepare the statement of fi nancial position of Cavern as at 30 September 2010.

Notes to the fi nancial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 5 marks

(c) 9 marks

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!