重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A.70 sec

B.140 sec

C.240 sec

D.270 sec

更多“If Trial 4 had been extended, at approximately what time would 0.45 mL of 0 2 have reacted”相关的问题

更多“If Trial 4 had been extended, at approximately what time would 0.45 mL of 0 2 have reacted”相关的问题

第1题

The following information is relevant for questions 9 and 10

A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,

and a suspense account appeared in the company’s draft balance sheet.

Subsequent checking revealed the following errors:

(1) The cost of an item of plant $48,000 had been entered in the cash book and in the plant account as $4,800.

Depreciation at the rate of 10% per year ($480) had been charged.

(2) Bank charges of $440 appeared in the bank statement in December 2005 but had not been entered in the

company’s records.

(3) One of the directors of the company paid $800 due to a supplier in the company’s payables ledger by a personal

cheque. The bookkeeper recorded a debit in the supplier’s ledger account but did not complete the double entry

for the transaction. (The company does not maintain a payables ledger control account).

(4) The payments side of the cash book had been understated by $10,000.

9 Which of the above items would require an entry to the suspense account in correcting them?

A All four items

B 3 and 4 only

C 2 and 3 only

D 1, 2 and 4 only

第2题

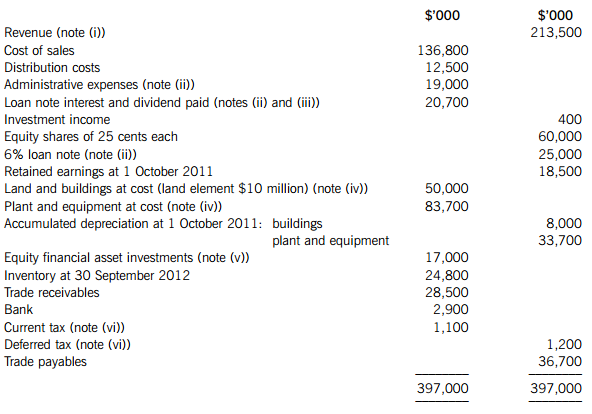

The following trial balance relates to Quincy as at 30 September 2012:

The following notes are relevant:

(i) On 1 October 2011, Quincy sold one of its products for $10 million (included in revenue in the trial balance). As part of the sale agreement, Quincy is committed to the ongoing servicing of this product until 30 September 2014 (i.e. three years from the date of sale). The value of this service has been included in the selling price of $10 million. The estimated cost to Quincy of the servicing is $600,000 per annum and Quincy’s normal gross profit margin on this type of servicing is 25%. Ignore discounting.

(ii) Quincy issued a $25 million 6% loan note on 1 October 2011. Issue costs were $1 million and these have been charged to administrative expenses. The loan will be redeemed on 30 September 2014 at a premium which gives an effective interest rate on the loan of 8%.

(iii) Quincy paid an equity dividend of 8 cents per share during the year ended 30 September 2012.

(iv) Non-current assets:

Quincy had been carrying land and buildings at depreciated cost, but due to a recent rise in property prices, it decided to revalue its property on 1 October 2011 to market value. An independent valuer confirmed the value of the property at $60 million (land element $12 million) as at that date and the directors accepted this valuation. The property had a remaining life of 16 years at the date of its revaluation. Quincy will make a transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation reserve. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2012. All depreciation is charged to cost of sales.

(v) The investments had a fair value of $15·7 million as at 30 September 2012. There were no acquisitions or disposals of these investments during the year ended 30 September 2012.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2011. A provision for income tax for the year ended 30 September 2012 of $7·4 million is required. At 30 September 2012, Quincy had taxable temporary differences of $5 million, requiring a provision for deferred tax. Any deferred tax adjustment should be reported in the income statement. The income tax rate of Quincy is 20%.

Required:

(a) Prepare the statement of comprehensive income for Quincy for the year ended 30 September 2012.

(b) Prepare the statement of changes in equity for Quincy for the year ended 30 September 2012.

(c) Prepare the statement of financial position for Quincy as at 30 September 2012. Notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 4 marks

(c) 10 marks

第3题

a profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 was

included in the balance sheet.

In subsequent checking the following errors were found:

(a) Depreciation of motor vehicles at 25 per cent was calculated for the year ended 31 December 2004 on the

reducing balance basis, and should have been calculated on the straight-line basis at 25 per cent.

Relevant figures:

Cost of motor vehicles $120,000, net book value at 1 January 2004, $88,000

(b) Rent received from subletting part of the office accommodation $1,200 had been put into the petty cash box.

No receivable balance had been recognised when the rent fell due and no entries had been made in the petty

cash book or elsewhere for it. The petty cash float in the trial balance is the amount according to the records,

which is $1,200 less than the actual balance in the box.

(c) Bad debts totalling $8,400 are to be written off.

(d) The opening accrual on the motor repairs account of $3,400, representing repair bills due but not paid at

31 December 2003, had not been brought down at 1 January 2004.

(e) The cash discount totals for December 2004 had not been posted to the discount accounts in the nominal ledger.

The figures were:

$

Discount allowed 380

Discount received 290

After the necessary entries, the suspense account balanced.

Required:

Prepare journal entries, with narratives, to correct the errors found, and prepare a statement showing the

necessary adjustments to the profit.

(10 marks)

第4题

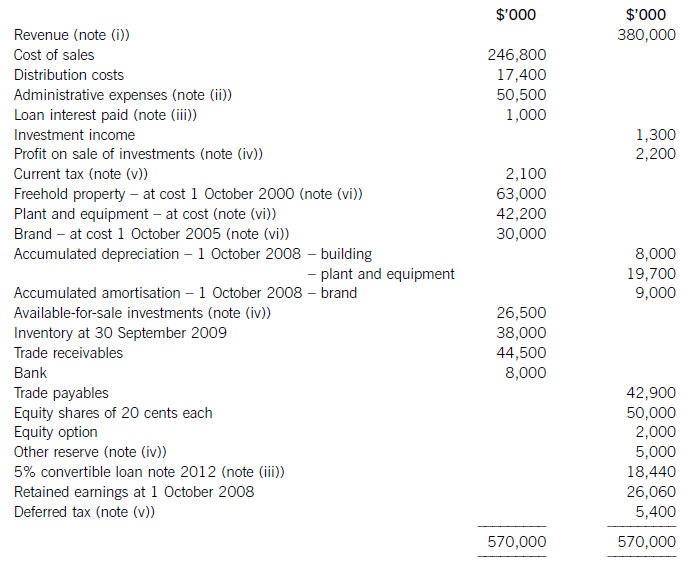

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

第5题

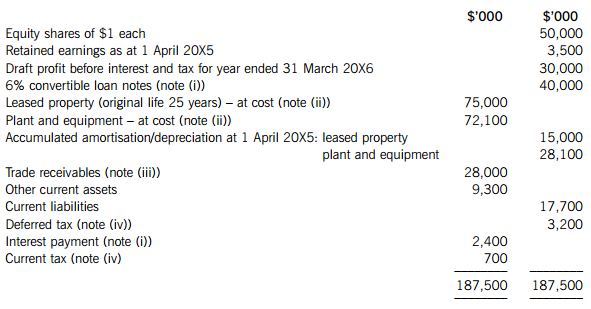

After preparing a draft statement of profit or loss (before interest and tax) for the year ended 31 March 20X6 (before any adjustments which may be required by notes (i) to (iv) below), the summarised trial balance of Triage Co as at 31 March 20X6 is:

The following notes are relevant:

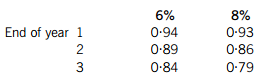

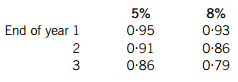

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

第6题

Passage Five

A young girl and a man were recently found murdered in a parked car in a Boston suburb. The police found no clue (线索) in the car. Then they found a witness who had seen a car pass by the murdered couple's car. He said it was a 1950 or 1951 Chevrolet (雪佛莱牌汽车).

Ordinarily, searching through the files for owners of elderly Chevies would have been an impossibly difficult task because there were two and a half million such cars. In this case, however, the police had a powerful tool--the computer.

The Boston Registry of Motor Vehicles programmed its computer to screen all 1950 and 1951 Chevrolets within a fifteen-mile radius (半径) of the suburb--the area in which the police believed the murderer was most likely to be found. Within minutes, the computer uncovered one thousand of the wanted cars. A few hours of careful hand screening turned up a 1950 Chevrolet owner who lived close to the scene of the crime and who had received many traffic tickets (交通罚款). He was among the first suspects to be investigated, and evidence linking him to the murdered couple was found. He was arrested, and is now waiting for trial (审判).

51. The computer DIDN'T help the police ______.

A. to find the suspect

B. to find the murdered couple

C. to arrest the suspect

D. to search a 1950 or 1951 Chevrolet

第7题

One suggestion that has been made in order to maximize the efficiency of the systems is to allow districts that have an overabundance of pending cases to borrow judges from other districts that do not have such a backlog. Another suggestion is to use pretrial conferences, in which the judge meets in his chambers with the litigants and their attorneys in order to narrow the issues, limit the witnesses, and provide for a more orderly trial. The theory behind pretrial conferences is that judges will spend less time on each case and parties will more readily settle before trial when they realize the adequacy of their claims and their opponents' evidence. Unfortunately, at least one study had shown that pretrial conferences actually use more judicial time than they save, rarely result in pretrial settlements, and actually result in higher damage settlements.

Many states have now established another method, small-claims courts, in which cases over small sums of money can be disposed of with considerable dispatch. Such proceedings cost the litigants almost nothing. In California, for example, the parties must appear before the judge without the assistance of counsel. The proceedings are quite informal and there is no pleading—the litigants need to make only a one-sentence statement of their claim. By going to this type of courts, the plaintiff waives any right to jury trial and the right to appeal the decision.

In coming years, we can expect to see more and more innovations in the continuing effort to remedy a situation which must be remedied if the citizens who have valid claims are going to be able to have their day in court.

The word "litigants" in Paragraph 1 refers to______.

A.judges

B.attorneys

C.persons concerned in a lawsuit

D.government officials

第8题

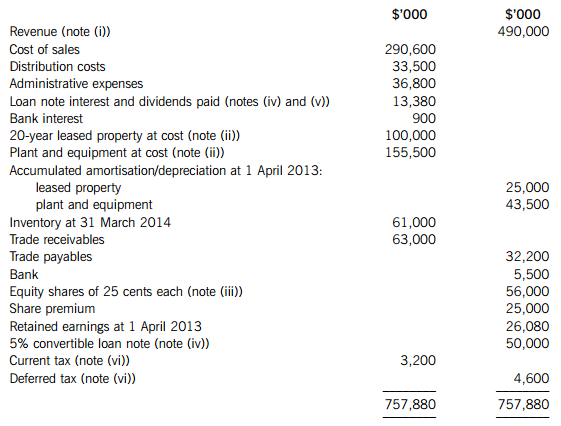

The following trial balance relates to Xtol at 31 March 2014:

The following notes are relevant:

(i) Revenue includes an amount of $20 million for cash sales made through Xtol’s retail outlets during the year on behalf of Francais. Xtol, acting as agent, is entitled to a commission of 10% of the selling price of these goods. By 31 March 2014, Xtol had remitted to Francais $15 million (of the $20 million sales) and recorded this amount in cost of sales.

(ii) Plant and equipment is depreciated at 12?% per annum on the reducing balance basis. All amortisation/depreciation of non-current assets is charged to cost of sales.

(iii) On 1 August 2013, Xtol made a fully subscribed rights issue of equity share capital based on two new shares at 60 cents each for every five shares held. The market price of Xtol’s shares before the issue was $1·02 each. The issue has been fully recorded in the trial balance figures.

(iv) On 1 April 2013, Xtol issued a 5% $50 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2016.

The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(v) An equity dividend of 4 cents per share was paid on 30 May 2013 and, after the rights issue, a further dividend of 2 cents per share was paid on 30 November 2013.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2013. A provision of $28 million is required for current tax for the year ended 31 March 2014 and at this date the deferred tax liability was assessed at $8·3 million.

Required:

(a) Prepare the statement of profit or loss for Xtol for the year ended 31 March 2014.

(b) Prepare the statement of changes in equity for Xtol for the year ended 31 March 2014.

(c) Prepare the statement of financial position for Xtol as at 31 March 2014.

(d) Calculate the basic earnings per share (EPS) for Xtol for the year ended 31 March 2014.

Note: Answers and workings (for parts (a) to (c)) should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 8 marks

(b) 6 marks

(c) 8 marks

(d) 3 marks

第9题

were not much changed from that they had been in old days. The __4__farmer aroused at dawn or before and had much work to do

第10题

A.has to increase

B.has been increasing

C.had been increased

D.has been increased

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!