重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

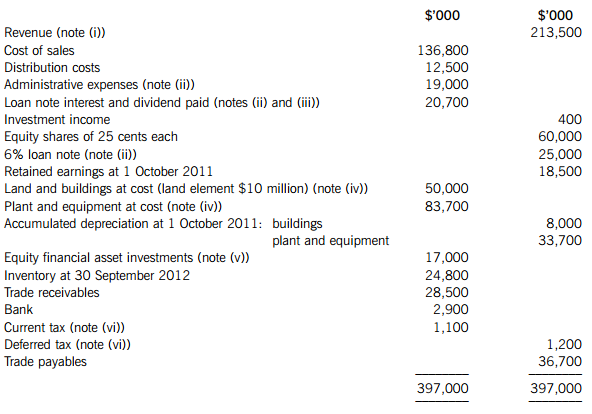

The following trial balance relates to Quincy as at 30 September 2012:

The following notes are relevant:

(i) On 1 October 2011, Quincy sold one of its products for $10 million (included in revenue in the trial balance). As part of the sale agreement, Quincy is committed to the ongoing servicing of this product until 30 September 2014 (i.e. three years from the date of sale). The value of this service has been included in the selling price of $10 million. The estimated cost to Quincy of the servicing is $600,000 per annum and Quincy’s normal gross profit margin on this type of servicing is 25%. Ignore discounting.

(ii) Quincy issued a $25 million 6% loan note on 1 October 2011. Issue costs were $1 million and these have been charged to administrative expenses. The loan will be redeemed on 30 September 2014 at a premium which gives an effective interest rate on the loan of 8%.

(iii) Quincy paid an equity dividend of 8 cents per share during the year ended 30 September 2012.

(iv) Non-current assets:

Quincy had been carrying land and buildings at depreciated cost, but due to a recent rise in property prices, it decided to revalue its property on 1 October 2011 to market value. An independent valuer confirmed the value of the property at $60 million (land element $12 million) as at that date and the directors accepted this valuation. The property had a remaining life of 16 years at the date of its revaluation. Quincy will make a transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation reserve. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2012. All depreciation is charged to cost of sales.

(v) The investments had a fair value of $15·7 million as at 30 September 2012. There were no acquisitions or disposals of these investments during the year ended 30 September 2012.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2011. A provision for income tax for the year ended 30 September 2012 of $7·4 million is required. At 30 September 2012, Quincy had taxable temporary differences of $5 million, requiring a provision for deferred tax. Any deferred tax adjustment should be reported in the income statement. The income tax rate of Quincy is 20%.

Required:

(a) Prepare the statement of comprehensive income for Quincy for the year ended 30 September 2012.

(b) Prepare the statement of changes in equity for Quincy for the year ended 30 September 2012.

(c) Prepare the statement of financial position for Quincy as at 30 September 2012. Notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 4 marks

(c) 10 marks

更多“The following trial balance relates to Quincy as at 30 September 2012:The following notes”相关的问题

更多“The following trial balance relates to Quincy as at 30 September 2012:The following notes”相关的问题

第1题

A.A jury trial

B.A church service

C.A political convention

D.An awards ceremony

第2题

Which of the following statements is not true of a trial balance?______.

A.A trial balance is a list of balances of ledger accounts worked out periodically.

B.A trial balance can detect an omission in the recording of the accounting data.

C.A trial balance provides an accuracy check by showing whether or not total debits equal total credits.

D.If total debits do not equal total credits in a trial balance, accounting error has occurred somewhere in journalizing or posting.

第3题

第4题

A.310000

B.140000

C.450000

D.590000

第5题

day of the trial?()

A.it was a historical regression for Darrow to see the author on trial.

B.people in the town took advantage of the trial to make money.

C.the judge and the jurors were narrow-minded and ignorant.

D.John's counsel included Darrow, Malone, Bryan and Hays.

第6题

A.Journalizing the transactions

B.Preparing a sale order

C.Posting of journal entries to ledger accounts

D.Preparing a trial balance

第7题

A、Unearned revenue.

B、Depreciation expense.

C、Accumulated depreciation.

D、Capital.

第8题

A.The attorney was an expert trial lawyer.

B.Every employee is entitled to see his personnel file.

C.The woman professor is afflicted by heart disease.

D.An employee requesting sick leave must file the required paper- work at least two weeks prior to her requested leave.

第9题

A.The woman professor is afflicted by heart disease.

B.The old Spanish attorney was an expert trial lawyer.

C.Some restaurants have a special menu for old people.

D.Employees requesting sick leave must file the required paper-work at least two weeks prior to their requested leave.

第10题

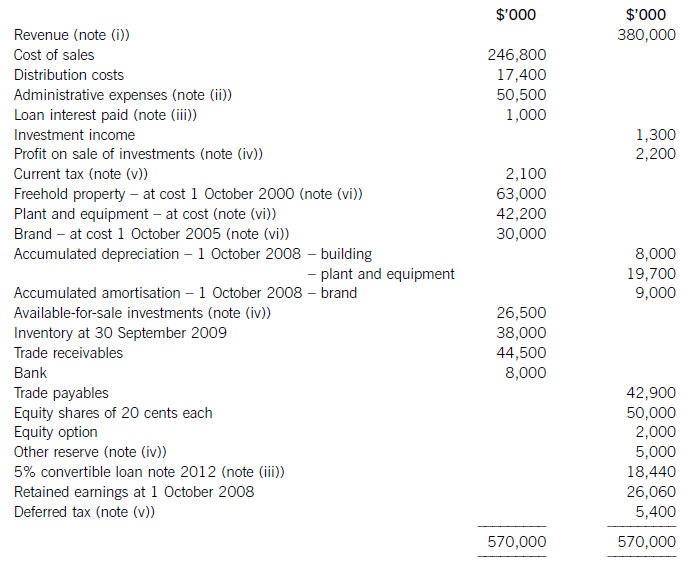

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

第11题

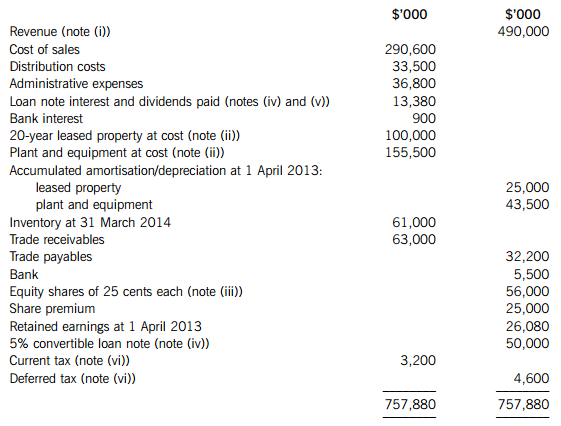

The following trial balance relates to Xtol at 31 March 2014:

The following notes are relevant:

(i) Revenue includes an amount of $20 million for cash sales made through Xtol’s retail outlets during the year on behalf of Francais. Xtol, acting as agent, is entitled to a commission of 10% of the selling price of these goods. By 31 March 2014, Xtol had remitted to Francais $15 million (of the $20 million sales) and recorded this amount in cost of sales.

(ii) Plant and equipment is depreciated at 12?% per annum on the reducing balance basis. All amortisation/depreciation of non-current assets is charged to cost of sales.

(iii) On 1 August 2013, Xtol made a fully subscribed rights issue of equity share capital based on two new shares at 60 cents each for every five shares held. The market price of Xtol’s shares before the issue was $1·02 each. The issue has been fully recorded in the trial balance figures.

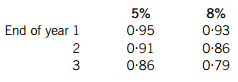

(iv) On 1 April 2013, Xtol issued a 5% $50 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2016.

The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(v) An equity dividend of 4 cents per share was paid on 30 May 2013 and, after the rights issue, a further dividend of 2 cents per share was paid on 30 November 2013.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2013. A provision of $28 million is required for current tax for the year ended 31 March 2014 and at this date the deferred tax liability was assessed at $8·3 million.

Required:

(a) Prepare the statement of profit or loss for Xtol for the year ended 31 March 2014.

(b) Prepare the statement of changes in equity for Xtol for the year ended 31 March 2014.

(c) Prepare the statement of financial position for Xtol as at 31 March 2014.

(d) Calculate the basic earnings per share (EPS) for Xtol for the year ended 31 March 2014.

Note: Answers and workings (for parts (a) to (c)) should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 8 marks

(b) 6 marks

(c) 8 marks

(d) 3 marks

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!