重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

A. option-free

B. callable

C. putable

更多“If three bonds are otherwise identical, the one exhibiting the highest level of positive”相关的问题

更多“If three bonds are otherwise identical, the one exhibiting the highest level of positive”相关的问题

第1题

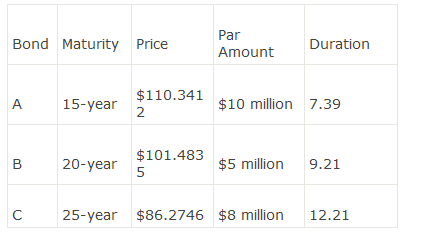

A. Bond A

B. Bond B

C. Bond C

第2题

A. 9.24

B. 9.60

C. 28.81

第3题

Bonds are commonly used in the Middle East area, so ______.

A.the Middle East banks often issue bonds

B.the Middle East exporters often demand bonds

C.the Middle East insurance companies often issue bonds

D.none of the above three is correct

第4题

Bond Features, Inc.(“BFI”) has bonds outstanding with a $900,00 par value.The BFI bonds pay a 4.5% coupon, mature in three years, and have net book value of $785,000.The bonds are convertible into 20,000 shares of common stock, with a $1 par value.The current market value of the common shares is $62.50.Under U.S.GAAP, the amount that will be recorded as additional paid-in capital if the bonds are immediately converted is closest to:

A.$115,000.

B.$765,000.

C.$1,250,000.

第5题

A. Yes.

B. No, Bond A’s nominal yield spread should be less than Bond C’s.

C. No, Bond B’s nominal yield spread should be less than Bond C’s.

第6题

(1)Al-year,9%couponbond票面利率为9%的1年期债券

(2)A 10-year, 9% coupon bond票面利率为9%的10年期债券

(3)A 10-year, 5% coupon bond票面利率为5%的10年期债券

What will happen to the price of each of these bonds if rates decrease? Which bond will have the greatest change in price? Explain.

如果利率下降,这些债券的价格会发生什么变化?哪支债券的价格变化最大?请解释。

第7题

A.Bond A carries an S&P rating of BB and a Moody’s rating of Baa.

B.Bond B carries an S&P rating of BBB and a Moody’s rating of Ba.

C.Bond C carries an S&P rating of BBB and a Moody’s rating of Baa.

D.None of the above.

第8题

Section B – TWO questions ONLY to be attempted

GNT Co is considering an investment in one of two corporate bonds. Both bonds have a par value of $1,000 and pay coupon interest on an annual basis. The market price of the first bond is $1,079?68. Its coupon rate is 6% and it is due to be redeemed at par in five years. The second bond is about to be issued with a coupon rate of 4% and will also be redeemable at par in five years. Both bonds are expected to have the same gross redemption yields (yields to maturity).

GNT Co considers duration of the bond to be a key factor when making decisions on which bond to invest.

Required:

(a) Estimate the Macaulay duration of the two bonds GNT Co is considering for investment. (9 marks)

(b) Discuss how useful duration is as a measure of the sensitivity of a bond price to changes in interest rates. (8 marks)

第9题

A.am studying

B.tudied

C.study

D.have studied

第10题

(A) My watch keeps good time

(B) My watch is five minutes fast

(C) My watch says three o’clock

(D) I say three o’clock

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!