重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

TQ Company, a listed company, recently went into administration (it had become insolvent and was being managed by a firm of insolvency practitioners). A group of shareholders expressed the belief that it was the chairman, Miss Heike Hoiku, who was primarily to blame. Although the company’s management had made a number of strategic errors that brought about the company failure, the shareholders blamed the chairman for failing to hold senior management to account. In particular, they were angry that Miss Hoiku had not challenged chief executive Rupert Smith who was regarded by some as arrogant and domineering. Some said that Miss Hoiku was scared of Mr Smith.

Some shareholders wrote a letter to Miss Hoiku last year demanding that she hold Mr Smith to account for a number of previous strategic errors. They also asked her to explain why she had not warned of the strategic problems in her chairman’s statement in the annual report earlier in the year. In particular, they asked if she could remove Mr Smith from office for incompetence. Miss Hoiku replied saying that whilst she understood their concerns, it was difficult to remove a serving chief executive from office.

Some of the shareholders believed that Mr Smith may have performed better in his role had his reward package been better designed in the first place. There was previously a remuneration committee at TQ but when two of its four non-executive members left the company, they were not replaced and so the committee effectively collapsed.

Mr Smith was then able to propose his own remuneration package and Miss Hoiku did not feel able to refuse him.

He massively increased the proportion of the package that was basic salary and also awarded himself a new and much more expensive company car. Some shareholders regarded the car as ‘excessively’ expensive. In addition, suspecting that the company’s performance might deteriorate this year, he exercised all of his share options last year and immediately sold all of his shares in TQ Company.

It was noted that Mr Smith spent long periods of time travelling away on company business whilst less experienced directors struggled with implementing strategy at the company headquarters. This meant that operational procedures were often uncoordinated and this was one of the causes of the eventual strategic failure.

(a) Miss Hoiku stated that it was difficult to remove a serving chief executive from office.

Required:

(i) Explain the ways in which a company director can leave the service of a board. (4 marks)

(ii) Discuss Miss Hoiku’s statement that it is difficult to remove a serving chief executive from a board.

(4 marks)

(b) Assess, in the context of the case, the importance of the chairman’s statement to shareholders in TQ

Company’s annual report. (5 marks)

(c) Criticise the structure of the reward package that Mr Smith awarded himself. (4 marks)

(d) Criticise Miss Hoiku’s performance as chairman of TQ Company. (8 marks)

更多“TQ Company, a listed company, recently went into administration (it had become insolvent a”相关的问题

更多“TQ Company, a listed company, recently went into administration (it had become insolvent a”相关的问题

第1题

A. private company

B. joint venture

C. listed company

D.state -owned company

第2题

A.Our company listed on the Hong Kong Stock Exchange in 1990.

B.Our company listed the Hong Kong Stock Exchange in 1990.

C.Our company was listed on the Hong Kong Stock Exchange in 1990.

第3题

A.The second level is the middle managers for the organization and they are all roughly equal in power.

B.A company structure chart will show the jobs,listed by job title,the reporting structure,and company management.

C.The departments are vertical under their department head,but horizontal with other divisions in the company.

D.The third level of a company structure chart is the top management for the organization.

第4题

(b) Explain the meaning of the term ‘Efficient Market Hypothesis’ and discuss the implications for a company if

the stock market on which it is listed has been found to be semi-strong form. efficient. (9 marks)

第5题

The following characteristics define its corporate culture:

l Customer-First Attitude

l Employee Dedication

l Long-Term Thinking

l Gradual Decision-Making

第6题

A.Disable the notify feature for the contoso.com zone.

B.Disable the allow-read permission for the everyone group on the contoso.com DNS domain.

C.Configure the all domain controllers in the domain zone replication option on ad.contoso.com.

D.Configure the allow zone transfers only to servers listed on the named servers option on contoso.com.

第7题

Brian: OK.(1)In other words, if you buy shares of stock in a business, you become a partial owner of the business.

Alicia: How can investors make money?

Brian: (2)if a person invests in a company that does very well.

Alicia: It's possible for the investors to get a complete loss, isn't it?

Brian: Everyone wants the stock market to go up, but sometimes, (3)This is usually true for all stocks.

A.The price of each share will go up.

B.even when a company does well the stock may go down.

C.Shares represent a partial ownership of the company.

D.There is a listed company behind every stock

第8题

A.the amount of the liability for the bonds payable will be the face value of the bonds minus any unamortized discount or plus any unamortized premium

B.the corporation would not be permitted to invest in bonds issued by other corporations while its own bonds payable remained outstanding

C.the liability section of the balance sheet should include all interest payable over the life of the bonds.

D.the amount of the liability for bonds payable will be offset against any investment by the company in bonds of other corporations.

第9题

(a) A director of Enca, a public listed company, has expressed concerns about the accounting treatment of some of the company’s items of property, plant and equipment which have increased in value. His main concern is that the statement of financial position does not show the true value of assets which have increased in value and that this ‘undervaluation’ is compounded by having to charge depreciation on these assets, which also reduces reported profit. He argues that this does not make economic sense.

Required:

Respond to the director’s concerns by summarising the principal requirements of IAS 16 Property, Plant and Equipment in relation to the revaluation of property, plant and equipment, including its subsequent treatment.

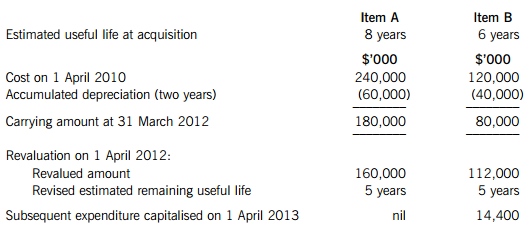

(b) The following details relate to two items of property, plant and equipment (A and B) owned by Delta which are depreciated on a straight-line basis with no estimated residual value:

At 31 March 2014 item A was still in use, but item B was sold (on that date) for $70 million.

Note: Delta makes an annual transfer from its revaluation surplus to retained earnings in respect of excess depreciation.

Required:

Prepare extracts from:

(i) Delta’s statements of profit or loss for the years ended 31 March 2013 and 2014 in respect of charges (expenses) related to property, plant and equipment;

(ii) Delta’s statements of financial position as at 31 March 2013 and 2014 for the carrying amount of property, plant and equipment and the revaluation surplus.

The following mark allocation is provided as guidance for this requirement:

(i) 5 marks

(ii) 5 marks (10 marks)

第10题

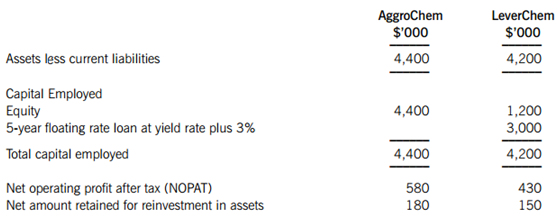

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!