重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

更多“Acquisition could be one company purchasing another entire company.()”相关的问题

更多“Acquisition could be one company purchasing another entire company.()”相关的问题

第1题

第2题

第3题

第4题

4 Hogg Products Company (HPC), based in a developing country, was recently wholly acquired by American Overseas

Investments (AOI), a North American holding company. The new owners took the opportunity to completely review

HPC’s management, culture and systems. One of the first things that AOI questioned was HPC’s longstanding

corporate code of ethics.

The board of AOI said that it had a general code of ethics that HPC, as an AOI subsidiary, should adopt. Simon Hogg,

the chief executive of HPC, disagreed however, and explained why HPC should retain its existing code. He said that

HPC had adopted its code of ethics in its home country which was often criticised for its unethical business behaviour.

Some other companies in the country were criticised for their ‘sweat shop’ conditions. HPC’s adoption of its code of

ethics, however, meant that it could always obtain orders from European customers on the guarantee that products

were made ethically and in compliance with its own highly regarded code of ethics. Mr Hogg explained that HPC had

an outstanding ethical reputation both locally and internationally and that reputation could be threatened if it was

forced to replace its existing code of ethics with AOI’s more general code.

When Ed Tanner, a senior director from AOI’s head office, visited Mr Hogg after the acquisition, he was shown HPC’s

operation in action. Mr Hogg pointed out that unlike some other employers in the industry, HPC didn’t employ child

labour. Mr Hogg explained that although it was allowed by law in the country, it was forbidden by HPC’s code of

ethics. Mr Hogg also explained that in his view, employing child labour was always ethically wrong. Mr Tanner asked

whether the money that children earned by working in the relatively safe conditions at HPC was an important source

of income for their families. Mr Hogg said that the money was important to them but even so, it was still wrong to

employ children, as it was exploitative and interfered with their education. He also said that it would alienate the

European customers who bought from HPC partly on the basis of the terms of its code of ethics.

Required:

(a) Describe the purposes and typical contents of a corporate code of ethics. (9 marks)

第5题

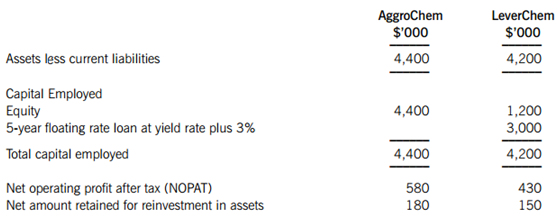

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

第6题

The restrictive laws that the courts are interpreting are mainly a legacy of the bank failures of the 1930s. The current high rate -- higher than at any time since the Great Depression -- has made legislators afraid to remove the restrictions. While legislative timidity is understandable, it is also mistaken. One reason so many American banks are getting into trouble is precisely that the old restrictions make it hard for them to build a domestic base large and strong enough to support their activities in today's telecommunicating round-the-clock, around-the-world financial markets. In trying to escape from these restrictions, banks are taking enormous, and what should be unnecessary, risks. For example, would a large bank be buying small, failed savings banks at inflated prices if federal law and states' regulations permitted that bank to expand through the acquisition of financially healthy banks in the region7 Of course not. The solution is clear American banks will be sounder when they are not geographically limited. The House of Representative's banking committee has shown part of the way forward by recommending common-sensible, though limited, legislation for a five-year transition to nationwide banking. This would give regional banks time to group together to form. counterweights to the big money-center banks. Without this breathing space the big money-legislation should be regarded as only a way station on the road towards a complete examination of American's suitable banking legislation.

The author’s attitude towards the current banking laws is best described as one of _______.

A.concerned dissatisfaction

B.tolerant disapproval

C.uncaring indifference

D.great admiration

第7题

Motivation is not an important factor in second language acquisition except.()

第8题

In second language acquisition, age is an important factor.()

第9题

第10题

Language acquisition refers to the child ’s acquisition of his ____.

A.first language

B.second language

C.foreign language

D.target language

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!