重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目

(iii) Explain the potential corporation tax (CT) implications of Tay Limited transferring work to Trent Limited,

and suggest how these can be minimised or eliminated. (3 marks)

更多“(iii) Explain the potential corporation tax (CT) implications of Tay Limited transferring”相关的问题

更多“(iii) Explain the potential corporation tax (CT) implications of Tay Limited transferring”相关的问题

第1题

(iii) Can internal audit services be undertaken for an audit client? (4 marks)

Required:

For each of the three questions, explain the threats to objectivity that may arise and the safeguards that

should be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions above.

第2题

A.中国多中心,双盲,随机对照,III期注册研究

B.试验组接受埃克替尼125mg qd po

C.埃克替尼中位暴露时间为22个月

D.中位随访24.9个月,DFS成熟度为50%,其中埃克替尼组成熟度>26%

第3题

4 (a) ISA 701 Modifications to The Independent Auditor’s Report includes ‘suggested wording of modifying phrases

for use when issuing modified reports’.

Required:

Explain and distinguish between each of the following terms:

(i) ‘qualified opinion’;

(ii) ‘disclaimer of opinion’;

(iii) ‘emphasis of matter paragraph’. (6 marks)

第4题

Section III Translation

Directions:

Translate the following text from English into Chinese. Write your translation

on ANSWER SHEET.

A fifth grader gets a homework assignment to select his future career path from a

list of occupations. He ticks “astronaut” but quickly adds “scientist” to the list and

selects it as well. The boy is convinced that if he reads enough, he can explore as

many careerpathsas he likes. And so he reads-everything from encyclopedias to

science fiction novels. He reads so passionately that his parents have to institute a “no

reading policy” at the dinner table.

That boy was Bill Gates, and he hasn’t stopped reading yet-not even after

becoming one of the most successful people on the planet. Nowadays, his reading

material has changed from science fiction and reference books: recently, he revealed

that he reads at least 50 nonfiction books a year. Gates chooses nonfiction titles

because they explain how the world works. “Each book opens upnewavenues of

knowledge to explore”, Gates says.

第5题

(c) Mr Cobar, the chief executive of SHC, has decided to draft two alternative statements to explain both possible

outcomes of the secrecy/licensing decision to shareholders. Once the board has decided which one to pursue,

the relevant draft will be included in a voluntary section of the next corporate annual report.

Required:

(i) Draft a statement in the event that the board chooses the secrecy option. It should make a convincing

business case and put forward ethical arguments for the secrecy option. The ethical arguments should

be made from the stockholder (or pristine capitalist) perspective. (8 marks)

(ii) Draft a statement in the event that the board chooses the licensing option. It should make a convincing

business case and put forward ethical arguments for the licensing option. The ethical arguments should

be made from the wider stakeholder perspective. (8 marks)

(iii) Professional marks for the persuasiveness and logical flow of arguments: two marks per statement.

(4 marks)

第6题

(a) (i) Identify and explain FOUR financial statement assertions relevant to classes of transactions and events for the year under audit; and

(ii) For each identified assertion, describe a substantive procedure relevant to the audit of REVENUE. (8 marks)

(b) Hawthorn Enterprises Co (Hawthorn) manufactures and distributes fashion clothing to retail stores. Its year end was 31 March 2015. You are the audit manager and the year-end audit is due to commence shortly. The following three matters have been brought to your attention.

(i) Supplier statement reconciliations

Hawthorn receives monthly statements from its main suppliers and although these have been retained, none have been reconciled to the payables ledger as at 31 March 2015. The engagement partner has asked the audit senior to recommend the procedures to be performed on supplier statements. (3 marks)

(ii) Bank reconciliation

During last year’s audit of Hawthorn’s bank and cash, significant cut off errors were discovered with a number of post year-end cheques being processed prior to the year end to reduce payables. The finance director has assured the audit engagement partner that this error has not occurred again this year and that the bank reconciliation has been carefully prepared. The audit engagement partner has asked that the bank reconciliation is comprehensively audited. (4 marks)

(iii) Receivables

Hawthorn’s receivables ledger has increased considerably during the year, and the year-end balance is $2·3 million compared to $1·4 million last year. The finance director of Hawthorn has requested that a receivables circularisation is not carried out as a number of their customers complained last year about the inconvenience involved in responding. The engagement partner has agreed to this request, and tasked you with identifying alternative procedures to confirm the existence and valuation of receivables. (5 marks)

Required:

Describe substantive procedures you would perform. to obtain sufficient and appropriate audit evidence in relation to the above three matters.

Note: The mark allocation is shown against each of the three matters above.

第7题

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

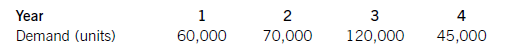

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

第8题

Lily Window Glass Co (Lily) is a glass manufacturer, which operates from a large production facility, where it undertakes continuous production 24 hours a day, seven days a week. Also on this site are two warehouses, where the company’s raw materials and finished goods are stored. Lily’s year end is 31 December.

Lily is finalising the arrangements for the year-end inventory count, which is to be undertaken on 31 December 2012. The finished windows are stored within 20 aisles of the first warehouse. The second warehouse is for large piles of raw materials, such as sand, used in the manufacture of glass. The following arrangements have been made for the inventory count:

The warehouse manager will supervise the count as he is most familiar with the inventory. There will be ten teams of counters and each team will contain two members of staff, one from the finance and one from the manufacturing department. None of the warehouse staff, other than the manager, will be involved in the count.

Each team will count an aisle of finished goods by counting up and then down each aisle. As this process is systematic, it is not felt that the team will need to flag areas once counted. Once the team has finished counting an aisle, they will hand in their sheets and be given a set for another aisle of the warehouse. In addition to the above, to assist with the inventory counting, there will be two teams of counters from the internal audit department and they will perform. inventory counts.

The count sheets are sequentially numbered, and the product codes and descriptions are printed on them but no quantities. If the counters identify any inventory which is not on their sheets, then they are to enter the item on a separate sheet, which is not numbered. Once all counting is complete, the sequence of the sheets is checked and any additional sheets are also handed in at this stage. All sheets are completed in ink.

Any damaged goods identified by the counters will be too heavy to move to a central location, hence they are to be left where they are but the counter is to make a note on the inventory sheets detailing the level of damage.

As Lily undertakes continuous production, there will continue to be movements of raw materials and finished goods in and out of the warehouse during the count. These will be kept to a minimum where possible.

The level of work-in-progress in the manufacturing plant is to be assessed by the warehouse manager. It is likely that this will be an immaterial balance. In addition, the raw materials quantities are to be approximated by measuring the height and width of the raw material piles. In the past this task has been undertaken by a specialist; however, the warehouse manager feels confident that he can perform. this task.

Required:

(a) For the inventory count arrangements of Lily Window Glass Co:

(i) Identify and explain SIX deficiencies; and

(ii) Provide a recommendation to address each deficiency.

The total marks will be split equally between each part (12 marks)

You are the audit senior of Daffodil & Co and are responsible for the audit of inventory for Lily. You will be attending the year-end inventory count on 31 December 2012.

In addition, your manager wishes to utilise computer-assisted audit techniques for the first time for controls and substantive testing in auditing Lily Window Glass Co’s inventory.

Required:

(b) Describe the procedures to be undertaken by the auditor DURING the inventory count of Lily Window Glass Co in order to gain sufficient appropriate audit evidence. (6 marks)

(c) For the audit of the inventory cycle and year-end inventory balance of Lily Window Glass Co:

(i) Describe FOUR audit procedures that could be carried out using computer-assisted audit techniques (CAATS);

(ii) Explain the potential advantages of using CAATs; and

(iii) Explain the potential disadvantages of using CAATs.

The total marks will be split equally between each part (12 marks)

第9题

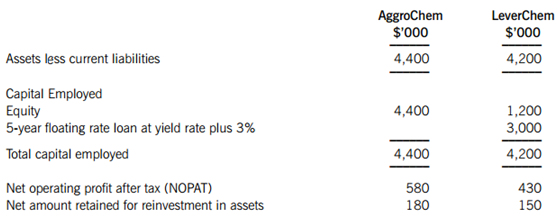

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!